|

trending

Sponsored Content

Following a revamp of production processes, beMatrix® is leading exhibitors into the future of sustainability The Future of Meetings and Events in 2025: Top Trends and Predictions by Global DMC Partners Moss Acquires Stretch Shapes, Expanding Production Capabilities in Live Event Experiences Calzone Anvil Cases Acquires Kangaroo, Expanding Texas Business Steelhead Productions Announces Key Promotions in 2024 GLOBUS Events Concludes Another Record Year for Pet Fair Network 3G Productions Names Jennifer Moore National Director of Business Development Fern Highlights Innovation, Growth, and Community Partnership at Expo!Expo! in Los Angeles L-Acoustics to Open Future Americas Operations Headquarters at Nashville Yards submit your news

email newsletter

|

Company News

IEG Board of Directors Approves the Draft Financial Statements and Consolidated Financial Statements as of 31 December 2022

3/16/2023

Rimini, 16 March 2023 - The Board of Directors of Italian Exhibition Group S.p.A. (Borsa Italiana S.p.A.: IEG), a company listed at Euronext Milan of Borsa Italiana S.p.A and a leading Italian company in the organization of international trade fair events, today approved its draft statutory financial statements and consolidated financial statements as at 31 December 2022.  IEG Group CEO Corrado Arturo Peraboni commented: " IEG Group closes 2022 with excellent results that mark the

substantial recovery compared to the pre-pandemic scenario, recording, in the second half of the year, a better

performance in terms of turnover than in 2019, as a result of solid organic growth in all business lines, and a progressive

improvement in margins, still affected by inflationary phenomena. Despite the elements of uncertainty in the

macroeconomic environment on expected global GDP growth, persistent inflation and rising interest rates, we are seeing

good signs of growth in the sector in which we operate, which have also been confirmed by the success of the first events

organized in early 2023, some of which achieved their best performance ever. We are therefore confident that we will

achieve the goals of the business plan by pursuing our investment and development strategy, both domestically and

internationally, through strategic partnerships, new acquisitions and expansion of our product."

IEG Group CEO Corrado Arturo Peraboni commented: " IEG Group closes 2022 with excellent results that mark the

substantial recovery compared to the pre-pandemic scenario, recording, in the second half of the year, a better

performance in terms of turnover than in 2019, as a result of solid organic growth in all business lines, and a progressive

improvement in margins, still affected by inflationary phenomena. Despite the elements of uncertainty in the

macroeconomic environment on expected global GDP growth, persistent inflation and rising interest rates, we are seeing

good signs of growth in the sector in which we operate, which have also been confirmed by the success of the first events

organized in early 2023, some of which achieved their best performance ever. We are therefore confident that we will

achieve the goals of the business plan by pursuing our investment and development strategy, both domestically and

internationally, through strategic partnerships, new acquisitions and expansion of our product."

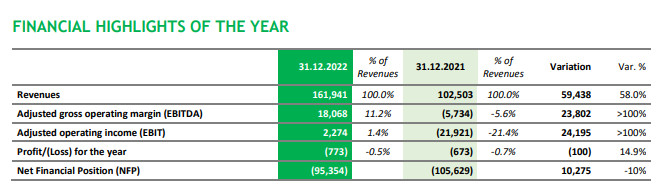

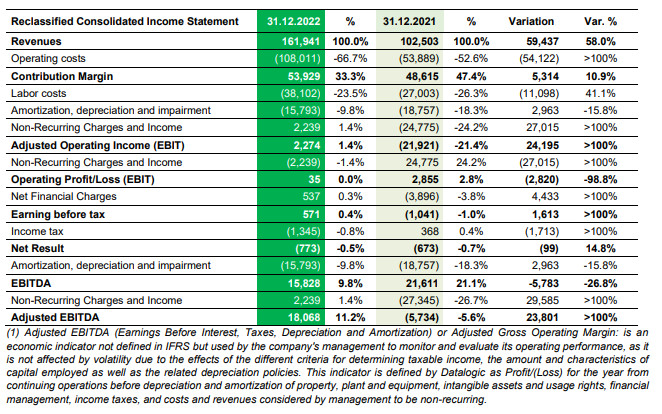

FINANCIAL HIGHLIGHTS OF THE YEAR

Group Revenues as of 31 December 2022 stood at 161.9 million euros, an increase of 59.4 million euros (+58.0%) from 31 December 2021. In the previous year, non-recurring income of approximately 28.2 million was recognized for Covid-19 grants received. The increase in sales net of Covid grants is 87.6 million euros. Financial year 2022 was characterized by a start of the year still negatively impacted by cyclical factors, primarily the resurgence of the Covid-19 pandemic, which forced the suspension of activity for most of the first quarter, while starting in the second half of the year, the sectors in which the Group operates showed strong signs of recovery, higher than expected, registering sales volumes, participation and satisfaction from operators, in some cases, higher than in the pre-pandemic scenario. Organic revenue growth in 2022 was 26.5 million euros (+25.9% compared to 2021), driven mainly by higher volumes on events in the second half of the year and partly by price effects. Revenue recovery related to the post-Covid restart (so-called 'Restart' effect) with the scheduling of cancelled, suspended, digitally held, or reduced events in 2021 amounted to 53.4 million euros (+52.1%), while incremental revenue for the biennial nature of some events contributed 4.3 million euros (+4.2%) to Financial Year 2022 revenues. With reference to the Group's only operating segment such as "Hosting of trade fairs, events and performance of related services," revenue figures disaggregated by line of business are shown below:

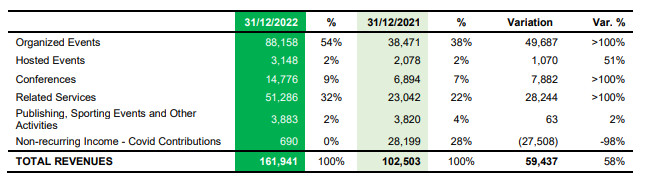

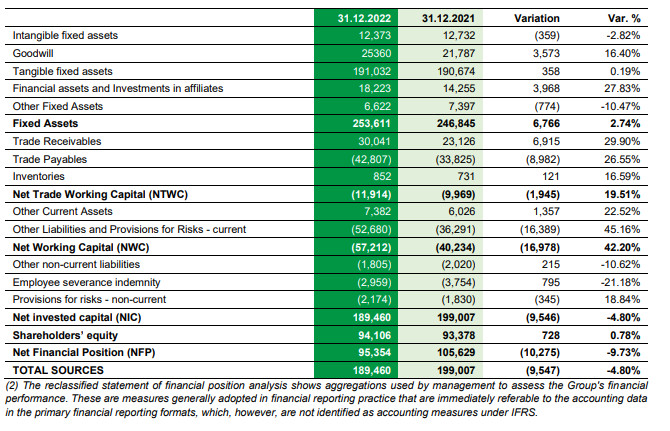

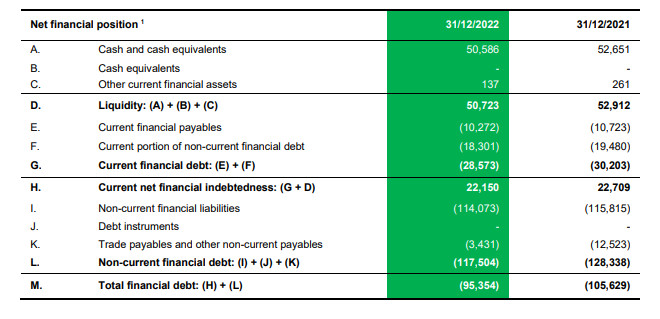

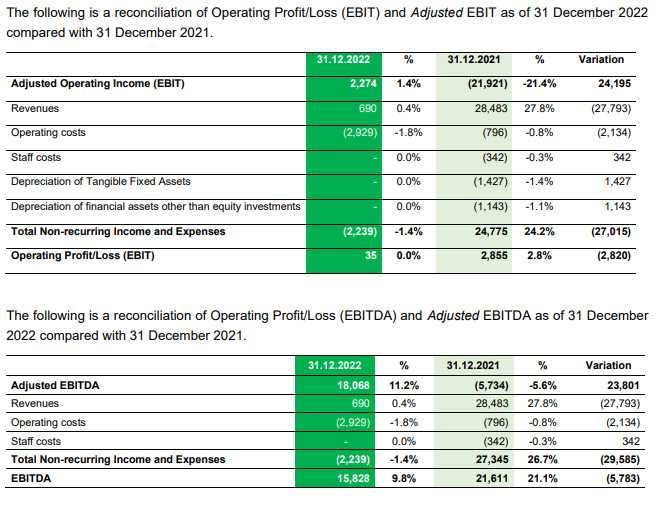

TOTAL REVENUES 161,941 100% 102,503 100% 59,437 58% Revenues from Organized Events were 88.2 million euros, an increase of 49.7 million compared to 2021, when the Group's activities had been suspended for most of the first half of the year. The share attributable to the “Restart” component affects 30.7 million euros, while the "Schedule" effect of 4.6 million euros is generated by biennial events such as 'Tecna' and 'IBE - Intermobility and Bus Expo,' partially offset by lower revenues from the scheduling of the 'Fieravicola' event. The organic growth achieved on this business line was 13.5 million euros. Organized Events suffered in the first half of 2022 from the effects of the latest pandemic wave induced by the Omicron variant of the Sars-Cov-2 infection, the peak of which occurred in January, the month in which important events such as 'Sigep', 'Vicenza Oro January' and 'TGold' are traditionally scheduled. Although no legislation has been introduced to prohibit trade fair-conferences, following discussions with the main stakeholders involved in the production and distribution chains of the companies taking part in the trade fairs of January and February, the Company decided to postpone the events Vicenza Oro January, TGold, Sigep and Beer & Food Attraction, from the original dates, to March. The change in the schedule clearly resulted in limited participation of both domestic and international exhibitors and visitors, significantly penalizing the results of the first quarter of the year compared to the pre-pandemic environment. The second quarter has seen certain important events back occupying the historic date, including 'Rimini Wellness', 'Oroarezzo' and 'Abilmente Primavera'. The first Solar Exhibition & Conference was also launched in April. Beginning in the third quarter of 2022, the signs of recovery gradually strengthened, with exhibitors' and visitors' great interest in the 'Vicenza Oro September and VO Vintage' event: industry professionals rewarded the only organizer which, throughout the pandemic period, continued to promote meeting platforms and events and proved to be a catalyst for the needs of the goldsmith community. The event also achieved record foreign visitor numbers, a clear sign of the strategic importance of the event for the industry not only nationally but also internationally. The business line represented by Hosted Events, through which the Group leases its exhibition facilities to clients operating in the event organization sector, generated revenues of 3.1 million euros and saw the holding of 10 events by third-party organizers. The growth recorded compared to 2021 is attributable in part to the excellent performance due to the return of the main events Macfrut and Expodental and in part to the acquisition of new events, also with a multi-year schedule, such as "Focus on PCB" and "YED" at Fiera di Vicenza; "We Make Future" at Rimini Fiera. The Congress Events segment, carried out through the management of the facilities of the Rimini Palacongressi and the Vicenza Convention Centre (VICC), in 2022 records revenues of 14.8 million euros, an increase of 7.9 million euros compared to 2021, represented for 5.5 million by the so-called "Restart" effect and 2.4 million by organic growth. Congress Activity, which was also initially held back by the pandemic, saw a total of 122 events held between Rimini's Palazzo dei Congressi and VICC (Vicenza). The congressional business has been extremely responsive, demonstrating a rapid return to pre-pandemic record levels. Revenues 2022 attributable to Services segment, for the provision of services linked to exhibition and convention events, reach a total revenue of approximately 51.3 million in 2022, an increase of 28.2 million compared to 31 December 2021. The increase was mainly due to the "Restart" effect of 17.0 million euros and organic growth of 9.4 million euros. The Related Services benefits from the recovery of the exhibition sector especially in the second half of the year. The business related to Publishing, Sports Events and Other Activities mainly includes publishing activities carried out for the tourism sector (TTG Italia, Turismo d'Italia and HotelMag) and for the gold sector (VO+ and Trendvision). Revenues from the line amounted to 3.9 million euros, an improvement of 0.1 million euros from 3.8 million euros in 2021. Operating Costs as of 31 December 2022 amounted to 108.0 million euros (53.9 million euros as of 31 December 2021), with the percentage of sales increasing from 52.6% (72.5% of sales normalized by the one-off effect of Covid contributions) to 66.7%. The volume recovery allows for a 5.8 percentage point improvement in the percentage of sales despite inflationary increases in material and transportation procurement costs on related services and energy costs. The Contribution Margin recorded in the year amounted to 53.9 million euros, up 5.3 million euros compared to the previous year (48.6 million euros). Net of the positive effect of Covid contributions, Value Added improves by 5.8 percentage points compared to 31 December 2021 from 27.5% to 33.3% recorded in 2022. Labor costs amounted to 38.1 million euros (23.5% of revenues), up 11.1 million euros compared to the 27.0 million euros (26.3% of revenues) recorded as of 31 December 2021, in which it was contained by the effects of social shock absorbers, the absence of variable components of wages and lower business volumes. Adjusted EBITDA, amounted to 18.1 million euros, an improvement of 23.8 million euros compared to 2021, when it was negative 5.7 million euros. EBITDA Margin as of 31 December 2022 returns to double digits at 11.2%, also improving on plan forecasts. In financial year 2022, particularly in the second half of the year, the Group recovers 16.8 percentage points due to higher volumes attributable not only to the post-pandemic restart, but also to organic growth that, in financial year 2022, was only able to partially recover the inflation-related increase in energy and material costs through tariff adjustments. EBIT as of 31 December 2022 closes at a break-even point, while in the previous year it was 2.8 million euros. Net of the Covid contribution and non-recurring income and expenses, Adjusted EBIT for financial year 2022 was 2.3 million euros, an improvement of 24.2 million euros from 31 December 2021. Net Financial charges is positive by 0.5 million euros and improves by about 4.4 million euros compared to 2021. The change is mainly attributable to the fair value of derivative financial instruments, an improvement of 2.0 million euros over 2021, and 1.7 million euros to lower charges related to the fair value of put options. Earning Before Taxes amounted to 0.6 million euros, an improvement of 1.6 million euros compared to 31 December 2021. Income Taxes for 2022 amounted to 1.3 million euros while in 2021 the tax income recognized amounted to 0.4 million euros. Group's Period Result was a loss of 0.8 million euros, broadly in line with the loss recorded in 2021 of 0.7. The Profit for the Period attributable to the shareholders of the Parent Company is positive, amounting to 0.8 million euros compared to 1.6 million euros in 2021. Net Invested Capital, at 189.5 million euros (199.0 million euros as of 31 December 2021), shows a decrease of 9.5 million euros, of which 6.7 million euros is an incremental change on fixed assets and 17.0 million euros on Net Working Capital. Fixed Assets (253.6 million euros as of 31 December 2022) marks an overall increase of 6.7 million euros mainly attributable to the acquisition of the subsidiary VGroup S.r.l. which resulted in the recognition of provisional goodwill of 2.9 million euros, while the change in financial assets of 3.9 million euros is mainly represented by the increase in unconsolidated equity investments, including the investment in IGECo S.r.l. for 3.4 million euros, against the acquisition of a 50 % stake in the company in a joint venture with Deutsche Messe AG (DMAG). Negative Net Working Capital and amounting to 57.2 million euros as of 31 December 2022, shows an increase of 17.0 million euros in relation to higher advance payments recorded against advances from customers for events to be held in the first quarter of 2023, and which in the previous year were more restrained due to reduced activity caused Covid. Group's Net Financial Position as of 31 December 2022 was 95.4 million euros, an improvement of 10.3 million euros compared to 31 December 2021. Operating cash generated in the year amounted to 19.6 million euros. Capital expenditures for the period amounted to 6.3 million euros and mainly related to routine maintenance of the fairgrounds and facilities of the production companies, as well as investments on information systems and digitization projects. Development investments completed through acquisitions totalled 6.6 million euros and related to both expansion in the Italian market with the acquisition of VGroup and expansion in the international market with the investment in the joint venture with Deutsche Messe AG. QUARTERLY PERFORMANCE

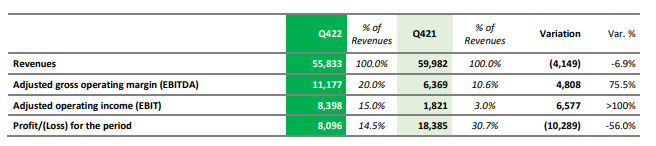

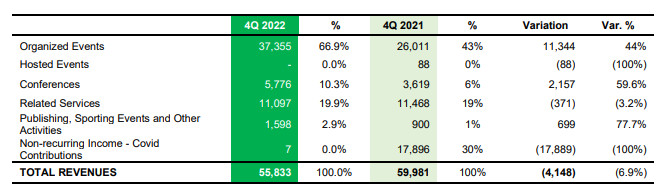

Fourth quarter 2022 recorded Revenues amounting to 55.8 million euros, net of non-recurring items represented by Covid contributions amounting to 17.9 million euros. The change in turnover compared to the same quarter 2021 is 13.8 million euros with an increase of 32.7 %, a result that marks not only full recovery, but also that the pre-pandemic levels have been exceeded. The growth was driven by the excellent performance of events such as 'Ecomondo and Key Energy,' in their last edition at the same time, which recorded record results in terms of occupancy, volumes and feedback from the community and institutions. On the international front, the 'Wellness' segment contributed to fourth quarter sales with two events in the Middle East and South America, respectively. More specifically, the 'Dubai Muscle Show' was held in October at the Dubai World Trade Center in Dubai. The event showed strong growth results on 2021 and great potential for development, while in November the first edition of 'BTTF - Brasil Trading Fair' was held in São Paulo, Brazil.

Adjusted EBITDA, achieved in the fourth quarter of the year reached 11.2 million euros, an improvement of 4.8 million euros compared to 2021 (6.4 million euros). EBITDA Margin as of 31 December 2022 returns to double-digit and pre-pandemic levels standing at 20.0% despite inflationary increases that sharpened in the second half of the year. Adjusted (EBIT for the fourth quarter was 8.4 million euros, an improvement of 6.6 million euros compared to 31 December 2021. The last quarter of the year closed with a Profit of 8.1 million euros, net of the Covid contribution, an improvement over the fourth quarter 2021 of 7.6 million euros. SIGNIFICANT EVENTS OF THE YEAR Governance On 18 July 2022, Marino Gabellini - Sole Director of Rimini Congressi S.r.l. - tendered his resignation from the office of Director, considering, with the approval of the 2022-2027 business plan. Gabellini was appointed from the list submitted by Rimini Congressi S.r.l., he did not qualify as an independent director and did not hold positions on the committees formed within the Board of Directors. In lieu of Marino Gabellini, on 29 August 2022, having obtained the opinion in favour of the Board of Auditors, the Board of Directors coopted Gian Luca Brasini as independent Board member until the next Shareholders’ Meeting, in accordance with article 2386 of the Italian Civil Code. On 14 November 2022, the Board of Directors, having obtained the opinion of the Board of Statutory Auditors, appointed Teresa Schiavina, the company's CFO, as Financial Reporting Officer following the resignation of Carlo Costa. Acquisitions During the year, the Group finalized both corporate and international acquisition and development transactions as outlined below.

On 10 March 2023, the Group obtained a positive response to the "waiver" request made to the pool of lending banks, for a waiver of compliance with the financial constraints for the year 2022 and in particular the "Leverage Ratio" constraint, which is not met due to a beginning of the year characterized by a resurgence of Covid-19 infections. The loan agreement, which is the subject of this waiver, was signed on 16 April 2020, 7 and, as of 31 December 2022, has an outstanding debt of approximately 10.2 million euros, which in this statement of assets and liabilities position is classified entirely as short-term in compliance with IAS 10. On 27 February 2023, the acquisition of a business unit containing the assets for the Singapore International Jewellery Event (SIJE) and Café Asia and Sweets & Bakes Asia & Restaurant Asia (CARA) two events that complete the Group's portfolio in Southeast Asia in the jewelry and food sectors was finalized. The cost of the acquisition consists of a fixed price portion, amounting to approximately 1.1 million euros, and a variable price portion, estimated at 1.1 million euros, to be paid in three tranches, based on the results achieved by the events to be held in 2023 and 2024. OUTLOOK The forecasted macroeconomic scenario for 2023 is marked by uncertainty. The lingering inflationary pressure and the consequent tight monetary policies, as well as the global geo-political tensions caused by the still ongoing conflict between Russia and Ukraine, play their part in curbing growth and the post pandemic full recovery of the Group reference market expected, globally, in 2024. Against this backdrop, despite the above effects, 2023 started with sound growth compared to the pre pandemic scenario. Booking targets for first half of 2023 have been already overachieved in the first months of 2023. IEG Group, thanks the faster pace of market recovery, started in the second half of 2022, which allowed the overachievement of Business Plan Targets in 2022, is confident to meet also in 2023 business plan financial targets continuing to put in place actions for an accretive recovery and improvement of operating margins as well as operating cash generation to sustain investments. The Board of Directors also approved the Report on Corporate Governance and Ownership Structure and the Consolidated Non-financial Statement pursuant to Legislative Decree. 254/2016. The Reports will be made available to the public WITHIN the terms and according to the methods prescribed by the relevant regulations. The Board of Directors has resolved to convene Shareholders to meet in an ordinary session on 28 April 2023 at single call. Attendance will only be possible via the Designated Representative in accordance with Art. 135- undecies of Italian Legislative Decree no. 58/98. The Call Notice accompanied by all the information prescribed in Article 125-bis of the Consolidated Law on Finance, as well as all documentation that will be submitted to the Meeting pursuant to Articles 125-ter and 125- quater of the Consolidated Law on Finance will be made available to the public, within the terms of the law, at the Company's registered office, Via Emilia 155, Rimini and on the Company's website www.iegexpo.it, Corporate Governance Section. An extract of the Call Notice will also be published in the newspaper Italia Oggi by the legal deadline. It should be noted that the auditing of the draft financial statements has not yet been finalized, and the auditors' report will therefore be made available within the legal deadlines. Finally, it should be noted that the attached income statement and balance sheet represent reclassified statements and as such are not subject to audit by the auditors. Lastly, it should be noted that the Annual Financial Report (pursuant to Article 154 ter of the Consolidated Law on Finance) of Italian Exhibition Group S.p.A. will be made available to the public at the company's registered office, at Borsa Italiana S.p.A. and at the authorized storage mechanism "1INFO Sdir e Storage," managed by ComputerShare S.p.A., as well as available for consultation on the company's website www.iegexpo.it (Investor Relations section) within the terms of applicable laws and regulations The manager in charge of preparing corporate accounting documents - Teresa Schiavina - declares, pursuant to paragraph 2 Article 154 bis of the Consolidated Law on Finance, that the accounting information contained in the press release corresponds to the documentary results, books and accounting records. The financial results for 2022 will be presented in a conference call with the Financial Community scheduled for today at 6:00 pm (CET). The presentation will be available in the Investor Relations section on the website www.iegexpo.it from 5:45 pm. It should also be noted that this press release contains forward-looking statements regarding the Group's intentions, beliefs, or current expectations regarding the Group's financial results and other aspects of the Group's activities and strategies. The reader of this press release should not place undue reliance on such forward-looking statements because actual results could differ significantly from those contained in such forecasts as a result of multiple factors, most of which are beyond the Group's control. For further information: ITALIAN EXHIBITION GROUP S.p.A. Investor Relations Martina Malorni |martina.malorni@iegexpo.it | +39 0541 744452 Press Contact Elisabetta Vitali |Head of media relations & corporate communication | elisabetta.vitali@iegexpo.it | +39 0541 744228 RECLASSIFIED FINANCIAL STATEMENTS ALTERNATIVE PERFORMANCE INDICATORS (API) Management uses certain performance indicators that are not identified as accounting measures under IFRS (NON-GAAP measures), to enable a better assessment of the Group's performance. The determination criterion applied by the Group may not be consistent with that adopted by other Groups and the indicators may not be comparable with those determined by the latter. These performance indicators, determined in accordance with the provisions of the Guidelines on Performance Indicators issued by ESMA/2015/1415 and adopted by CONSOB in Notice No. 92543 of 3 December 2015, refer only to the performance of the accounting period covered by this Consolidated Annual Financial Report and the periods compared. The performance indicators should be considered as complementary and do not replace the information drafted in accordance with the IFRSs. Below is a description of the main indicators adopted.

RECLASSIFIED BALANCE SHEET AS OF 31 DECEMBER 2022 (2)

NET FINANCIAL POSITION AS OF 31 DECEMBER 2022 (3)

ALTERNATIVE PERFORMANCE INDICATORS (API) RECONCILIATION

The alternative performance indicators shown above are adjusted for income components arising from non-recurring events or operations, restructuring activities, business reorganization, depreciation of fixed assets, ancillary expenses related to acquisitions of businesses or companies or their disposals, extraordinary transactions, and any other events not representative of normal business activity. Contact: questions@exhibitormagazine.com |

FIND IT - MARKETPLACE

|

|

||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

TOPICS Measurement & Budgeting Planning & Execution Marketing & Promotion Events & Venues Personal & Career Exhibits & Experiences International Exhibiting Resources for Rookies Research & Resources |

MAGAZINE Subscribe Today! Renew Subscription Update Address Digital Downloads Newsletters Advertise |

FIND IT Exhibit & Display Producers Products & Services All Companies Get Listed |

EXHIBITORLIVE Sessions Certification Exhibit Hall Exhibit at the Show Registration |

ETRAK Sessions Certification F.A.Q. Registration |

EDUCATION WEEK Overview Sessions Hotel Registration |

CERTIFICATION The Program Steps to Certification Faculty and Staff Enroll in CTSM Submit Quiz Answers My CTSM |

AWARDS Sizzle Awards Exhibit Design Awards Portable/Modular Awards Corporate Event Awards Centers of Excellence |

NEWS Associations/Press Awards Company News International New Products People Shows & Events Venues & Destinations EXHIBITOR News |

||||||||||||||||||||

|

||||||||||||||||||||||||||||