uy or sell? Hold or hedge? Belly up or hunker down? Stock and foreign-exchange traders make these risk-riddled decisions every day. But put these same self-assured people on the trade show floor, and they become as skittish as squirrels on speed.

"There are a host of highly regarded companies in the foreign-exchange-trading industry," says Marilyn McDonald, director of

marketing at Interbank FX LLC, a foreign-exchange (forex) broker in Salt Lake City. "However, there are several, shall we say, 'not so reputable' companies that have established a degree of mistrust among traders." For exhibitors, this mistrust means that simply getting traders to enter their booth, much less take a brochure, is like trying to convince a skittish squirrel to walk through your front door and snatch a peanut from your palm.

So for The Las Vegas Forex Trading Expo in September 2007, Interbank needed an in-booth experience that would bypass attendees' anti-trust barriers and entice them to experience its trading platform for themselves. McDonald's solution was the Micro Mini Challenge, a forex-trading competition based on her theory that traders' competitive natures trumped their mistrust of exhibitors.

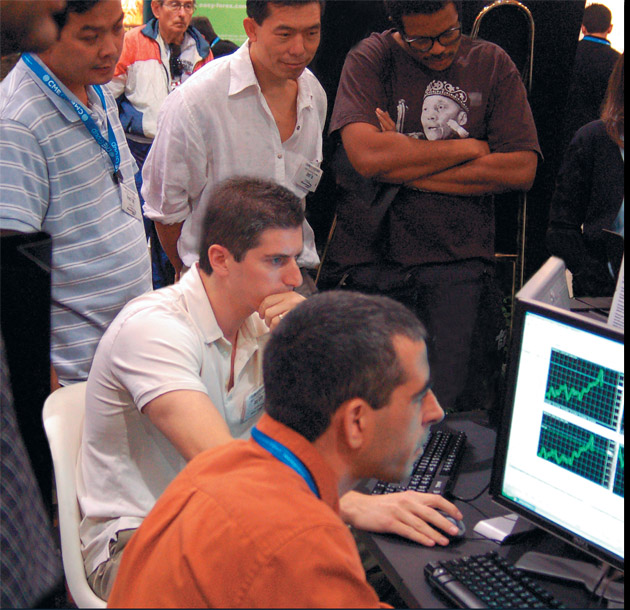

Drawn by their love of competition and the allure of cool prizes - a "Forex Simplified" book for all participants and an iPod Nano for each winner - attendees warily approached the 10-by-20-foot booth and took a seat behind one of four monitors. Meanwhile, a host explained the competition: Participants would be given roughly $10,000 in faux funds, and after 10 minutes of trading using canned, streaming data and Interbank's trading platform, the trader with the most equity would be crowned the winner.

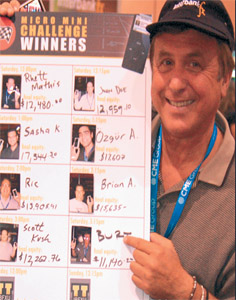

Then, with the flip of a switch, which fed the streaming data to competitors' computers, the host yelled "Trade!" Without as much as a twitch or twitter, competitors and onlookers eagerly immersed themselves in the competition - and Interbank's platform. After a frenzied 10 minutes, the host yelled, "Stop trading!" and then flipped the switch on the canned feed and announced the winner. A staffer then photographed each winner and posted the photo and the total equity he or she accrued onto the winners board.

According to Sizzle Awards judges, Interbank's in-booth activity created a sort of "rolling mob mentality and a competitive experience traders just couldn't resist." That mob, however, also equated to 1,200 booth visitors by show's end - four times Interbank's 2006 show figures.

What's more, after the show, those visitors didn't just squirrel away their knowledge; they signed up for paid accounts. While new-account signups reached 1,502 in September, they spiked in October and November at 1,672 and 1,789, respectively.

Using little more than in-house talent and a shoestring budget, Interbank created an in-booth activity that not only engaged attendees in a fun-filled product demo, it calmed their fears and convinced them to open accounts. Paying major dividends for a minimal investment, this is the kind of return any investor can appreciate. e

|

Drive 400 traders (20 percent of attendees) to the booth.

Drive 400 traders (20 percent of attendees) to the booth.