According to the results of Exhibit Surveys Inc.'s Trade Show Trends report,

the exhibition industry held steady in 2013, with a small yet significant increase in traffic density. Despite what feels like a performance plateau,

trade shows continue to attract attendees with the power and intention to buy.

By Travis Stanton and Ian K. Sequeira

hile 2012 proved to be a year of growth and recovery for the trade show industry, a look back at 2013 indicates last year was more about traction and stabilization. The Great Recession had mostly subsided, but the year didn't include many marketing-industry milestones. Sure, most shows saw at least slight increases in attendance, and several boasted more exhibiting companies and net square footage than in recent history, but significant growth was the exception, while moderate gains were more common.

Each year, Red Bank, NJ-based Exhibit Surveys Inc. polls attendees from more than 30 U.S. trade shows to determine the effectiveness of exhibit marketing and indentify industry benchmarks. The company's 2013 Trade Show Trends report includes information about exhibit performance, show-floor traffic, and trade show attendees – their buying power, purchase plans, and attendance habits.

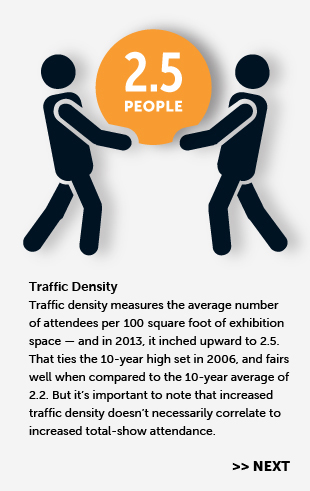

Traffic density – the average number of attendees per square foot of exhibition space – was up in 2013. When that metric dropped during the Great Recession, some theorized that it created a concentrated audience of more qualified attendees. In other words, they believed the tire kickers were staying home, but the real buyers were still making the trip to attend their industries' respective trade shows. However, as traffic density is inching back up again, audience quality appears to be holding steady.

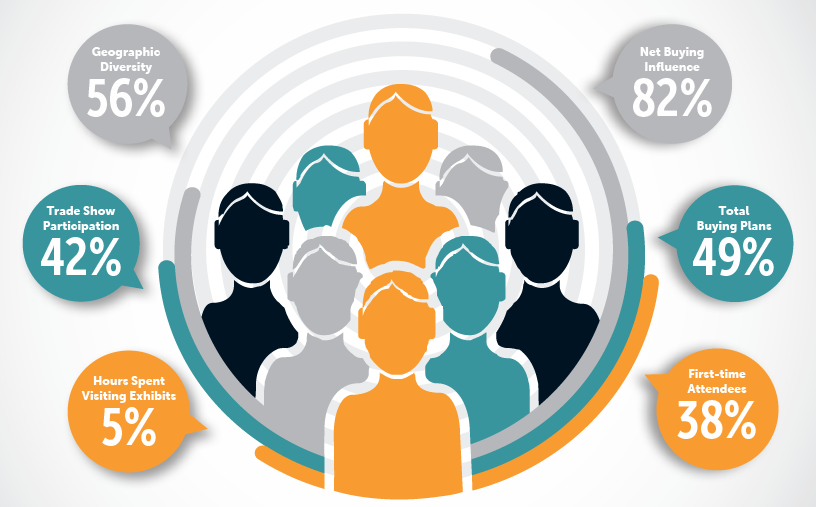

The survey also determined that 82 percent of trade show attendees have the power to recommend, specify, and/or make final purchasing decisions. Perhaps more importantly, 49 percent come to trade shows with purchasing intent. While those statistics are nearly identical to those from 2012, they compare favorably to long-term industry averages, meaning we may have finally returned to some semblance of business as usual.

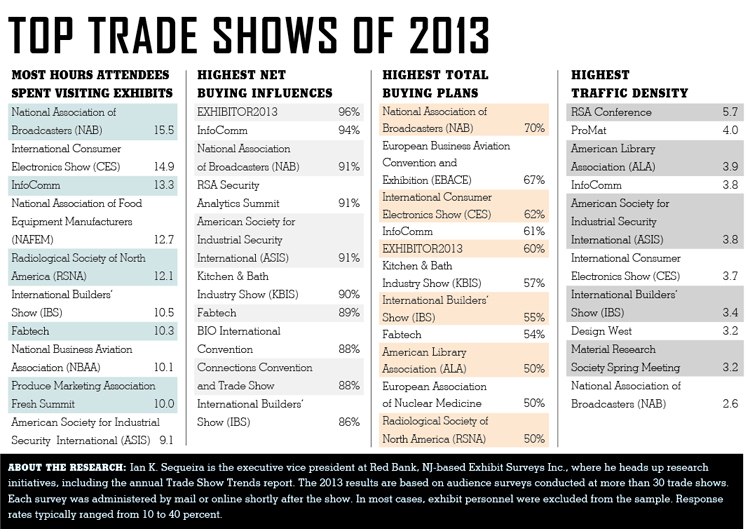

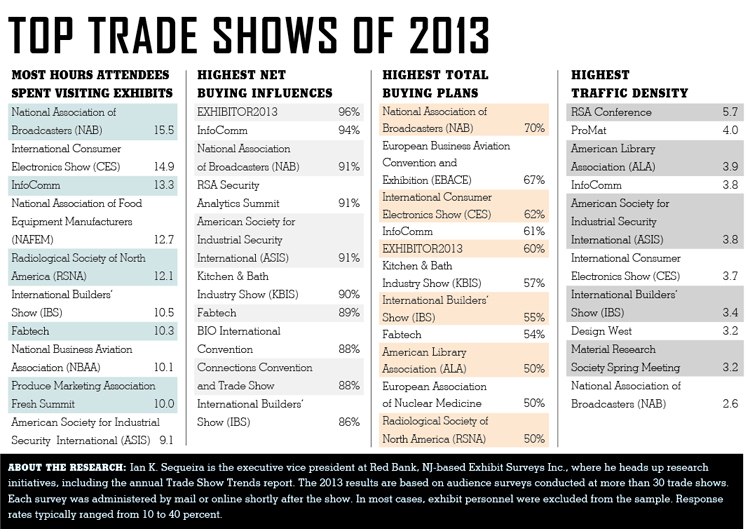

The following data represents some of the highlights from this year's report, along with a list of last year's top trade shows.

hile 2012 proved to be a year of growth and recovery for the trade show industry, a look back at 2013 indicates last year was more about traction and stabilization. The Great Recession had mostly subsided, but the year didn't include many marketing-industry milestones. Sure, most shows saw at least slight increases in attendance, and several boasted more exhibiting companies and net square footage than in recent history, but significant growth was the exception, while moderate gains were more common.

hile 2012 proved to be a year of growth and recovery for the trade show industry, a look back at 2013 indicates last year was more about traction and stabilization. The Great Recession had mostly subsided, but the year didn't include many marketing-industry milestones. Sure, most shows saw at least slight increases in attendance, and several boasted more exhibiting companies and net square footage than in recent history, but significant growth was the exception, while moderate gains were more common.