|

ALL STAR |

Jeffrey Masters, a senior manager, global event marketing group, Philips Healthcare, has worked in all phases of the event industry for nearly 40 years, from planning public events for the city of Boston to exhibit design and production. In his current role at Philips, Masters is responsible for the customer experience and event measurement. Jeffrey Masters, a senior manager, global event marketing group, Philips Healthcare, has worked in all phases of the event industry for nearly 40 years, from planning public events for the city of Boston to exhibit design and production. In his current role at Philips, Masters is responsible for the customer experience and event measurement. |

|

lbert Einstein once said, "Not everything that can be counted counts, and not everything that counts can be counted." But the Nobel laureate who was hailed as the father of modern physics couldn't have been more wrong - and Jeffrey Masters of Philips Healthcare proved it with what one of our All-Star Awards judges called "A powerful, impactful

program that produced the kind of data management face-to-face marketers dream about." lbert Einstein once said, "Not everything that can be counted counts, and not everything that counts can be counted." But the Nobel laureate who was hailed as the father of modern physics couldn't have been more wrong - and Jeffrey Masters of Philips Healthcare proved it with what one of our All-Star Awards judges called "A powerful, impactful

program that produced the kind of data management face-to-face marketers dream about."

When Masters joined the Andover, MA-based division of Philips Electronics N.V. as a senior manager in its global event marketing group in 2007, he walked into a challenge as daunting as figuring out E=MC˛. Philips management had tasked their new hire with proving how much his department contributed to the company by quantifying who attended key shows, what they were shopping for, and how booth behavior correlated to buying patterns. Then they plopped a cherry on top of that stress-inducing sundae by asking Masters to prove what expos such as the Radiological Society of North America (RSNA) were worth to the company.

Knowing What Counts

Accomplishing this feat would be difficult under any circumstances, but with the company's antiquated approach to measurement - post-show reports were based on a meager combination of perfunctory surveys and card swipes that gleaned only attendees' names and organizations - it was like asking the United States Census Bureau to keep track of America's millions with an abacus. The skeletal metrics were frustratingly nebulous for an $11-billion company that manufactures medical technology, from magnetic resonance imaging (MRI) to computed tomography (CT). "We were measuring ghosts," Masters says, "things you couldn't really get your hands around and make concrete conclusions about." Accomplishing this feat would be difficult under any circumstances, but with the company's antiquated approach to measurement - post-show reports were based on a meager combination of perfunctory surveys and card swipes that gleaned only attendees' names and organizations - it was like asking the United States Census Bureau to keep track of America's millions with an abacus. The skeletal metrics were frustratingly nebulous for an $11-billion company that manufactures medical technology, from magnetic resonance imaging (MRI) to computed tomography (CT). "We were measuring ghosts," Masters says, "things you couldn't really get your hands around and make concrete conclusions about."

Normally, Masters might take a few months to research new technologies and strategies and craft an innovative

approach, but he had come on board at Philips just four weeks before the company was due to exhibit at RSNA in Chicago. With annual professional attendance since 2007 exceeding 27,000, and exhibitors numbering more than 700, RSNA is often referred to as the world's largest

international medical show. For Philips, in fact, RSNA is a bellwether show that kicks off its annual sales cycle for its imaging systems, including CT, MRI, ultrasound, digital X-ray, and nuclear medicine. Held every year in the Windy City, the RSNA show is tied to millions of dollars in Philips' yearly revenues, or so the conventional wisdom held. But nobody could actually prove it using the old measuring sticks - especially since the sales cycle routinely takes anywhere from nine months to two years. "And I only had a few weeks to update an ineffective system that had been in place for years," Masters says.

Scrambling together a plan in less than a month, Masters' strategy was to mix what he dubbed a "measurement cocktail" by blending data from multiple sources: interviews with booth visitors, information collected by RSNA show management, and a post-show survey of booth visitors 60 days after RSNA rolled up the carpets and shut the doors. At that point, Masters would gather the data, evaluate and graph it, and then deliver a comprehensive report to management projecting what attendees planned to purchase. Scrambling together a plan in less than a month, Masters' strategy was to mix what he dubbed a "measurement cocktail" by blending data from multiple sources: interviews with booth visitors, information collected by RSNA show management, and a post-show survey of booth visitors 60 days after RSNA rolled up the carpets and shut the doors. At that point, Masters would gather the data, evaluate and graph it, and then deliver a comprehensive report to management projecting what attendees planned to purchase.

The data would be finely sifted to prove to Philips' management how many millions the RSNA show meant to the company in CT or MRI sales, for example. It would also, he hoped, ease the never-ending battle to justify the global event marketing department's budget by showing how events contributed to meeting the business objectives in the marketplace. Yet none of that might have been possible without one other data-collection technology Masters didn't know he needed, but which would begin a three-year-long effort at RSNA that propelled him into the constellation of EXHIBITOR magazine's All Stars.

If "luck is what happens when preparation meets opportunity," as the Roman philosopher Seneca once said, then Masters was about to be win-the-lotto lucky. RSNA management happened to be offering a radio-frequency identification (RFID) system to seven exhibitors, including Philips, for the 2007 show as a test run for the technology. Originating in World War II, today's RFID systems consist of two basic parts: an integrated circuit

and an antenna. The integrated circuit stores and processes information, while the antenna receives and transmits a radio signal to a computer. The size of bulky vacuum-tube radios back when the axis of evil was in Germany and Japan, RFID units have now been made so small that entomologists are attaching them to ants to track the insects. The price of the type of RFID tags the RSNA show deployed has also plummeted in proportion to their ant-like size, from about $5 per unit in 2000 to roughly 50 cents apiece today. For Masters, this was a dream come true: RFID could help him grab the brass ring of correlating attendees' booth behavior - such as the amount of time people spent in a product-demo area, or the number of repeat visits they made to the booth or even a particular section within it - with later sales.

Knowing that it's sometimes easier to ask for forgiveness than to ask for permission, Masters quietly signed up Philips for the RFID systems without really alerting management. The cost tacked on no more than an estimated 2 percent to Masters' budget while allowing him an opportunity to capture data that could almost literally be priceless. "We figured, we'll talk about it later if it's any good," Masters says, "and if it's not, well . "

Masters knew he had stumbled onto the info-junkie's version of Aladdin's fabled wish-granting lamp. Starting

with RSNA 2007, he launched the opening salvo of an information

revolution that would transform Philips' old-timey exhibit measurements into the new hotness of sophisticated, layered metrics with the help of RFID tracking technology. "I have a favorite quote from Dr. Atul Gawande's book, 'Better: A Surgeon's notes on Performance,'" Masters says. "It goes, 'If you count something you find interesting, you will learn something interesting.'

There were lots of things I found interesting in trade shows. Now I could measure a good number of them."

Tag, You're It Tag, You're It

The 28,364 professional attendees who showed up at McCormick Place for RSNA 2007 could opt out of using the badges that came standard with the embedded RFID microchips called "tags," but just 4 percent did. Provided by Austin, TX-based Alliance Tech Inc., the RFID system could in theory be used to transmit virtually any information to participating exhibitors about an individual that was listed in the attendee's registration record. But the only personal data the system at RSNA revealed was a unique ID number and an attendee's name, country, city, company, and job title - the very same info, in other words, that was available, Gutenberg-style, on their badges. Personal contact information, such as phone numbers, physical addresses, and e-mail information, was inaccessible to Philips and the half-dozen other companies using RFID. Of much greater value to Philips was the system's ability to track variables such as how long unique visitors lingered in its booth, as well as where they wandered in the exhibit and how long they stayed in particular areas. Once Masters compiled that data,

he would begin reshaping Philips'

exhibiting program and start proving its worth to management based on hard evidence.

Designed by the Atlanta division of exhibit and event firm Czarnowski Inc., Philips' 28,000-square-foot booth was divided into about 15 imaging-product areas, such as nuclear medicine and ultrasound, to attract its core target of radiology-department administrators, radiologists, and senior technicians in the field. Once a visitor entered the booth, one of the more than 1,200 staff (who were outfitted with generic RFID tags to monitor their behavior) swiped badges in the various product areas to generate leads, which were passed on to sales. Often through a brief conversation, staff might qualify the prospects who openly expressed an interest in purchasing - or a lack thereof - as hot, medium, or cold. The flesh-and-blood interaction was overshadowed, however, by the RFID surveillance. Setting up 25 data-collection antennae near the product stations around the booth that could pick up signals from attendees' badges

up to 16 feet away, Philips stealthily logged where visitors went and how long they stayed, among the approximately 35 variables it tracked. Designed by the Atlanta division of exhibit and event firm Czarnowski Inc., Philips' 28,000-square-foot booth was divided into about 15 imaging-product areas, such as nuclear medicine and ultrasound, to attract its core target of radiology-department administrators, radiologists, and senior technicians in the field. Once a visitor entered the booth, one of the more than 1,200 staff (who were outfitted with generic RFID tags to monitor their behavior) swiped badges in the various product areas to generate leads, which were passed on to sales. Often through a brief conversation, staff might qualify the prospects who openly expressed an interest in purchasing - or a lack thereof - as hot, medium, or cold. The flesh-and-blood interaction was overshadowed, however, by the RFID surveillance. Setting up 25 data-collection antennae near the product stations around the booth that could pick up signals from attendees' badges

up to 16 feet away, Philips stealthily logged where visitors went and how long they stayed, among the approximately 35 variables it tracked.

By the show's end, Masters had marshaled enough data to cram an Excel spreadsheet with 90,000 rows of data. But raw data without a savvy interpreter is like a blank canvas without a Rembrandt. Masters mashed up variables to his heart's content, analyzing traditional exhibit info more deeply than ever, and realizing entirely new patterns. He discovered, for example, that more than 9,000 unique attendees had visited the booth a

grand total of nearly 27,000 times, with some staying as little as 30 seconds while others loitered as long as 123 minutes. When breast radiologists from the University of Chicago Hospitals

strolled through the MRI area, for

instance, Masters could note how much time they spent watching a demonstration of MammoTrak, the portable breast MRI trolley Philips debuted at the show. grand total of nearly 27,000 times, with some staying as little as 30 seconds while others loitered as long as 123 minutes. When breast radiologists from the University of Chicago Hospitals

strolled through the MRI area, for

instance, Masters could note how much time they spent watching a demonstration of MammoTrak, the portable breast MRI trolley Philips debuted at the show.

Masters doesn't reveal sales figures or even release many hard numbers on what Philips discovered under the new and improved system (Masters and the company make the CIA look as chatty as the hosts of "The View"), but he is as openly as confident of it as a bird is of flight. "There's a truth machine in all of this, especially the RFID," he says, "and it gave me hard metrics that made the conversation about the productivity of the exhibit much more robust."

RFID Repeat

Masters entered RSNA 2008 with the previous show's mosaic of intelligence as his baseline. He signed up again for the RFID service offered by show management, and this time, Philips' 32,000-square-foot exhibit was about 14.5 percent larger than the 2007 booth - a sign, in part, of Masters' success in demonstrating the exhibit's value to management. On the heels of that achievement, Philips exploited RFID even more dramatically, placing about 65 antennae (40 more than he used in the 2007 exhibit) in the booth; the greater concentration would enable him to track traffic more precisely over the additional space.

Analyzing the 2007 show data had taught Masters when and where people were most likely to congregate, which gave him an advantage in knowing where to focus his resources. For instance, if it looked like attendees from Germany inexplicably spent only a few minutes in a section they had shown a keen interest in at previous shows, such as nuclear medicine, Masters could check to see if enough sprechen-sie-Deutsch staff had been in the vicinity at the same time. So precise was the data, it helped enable

Masters to reduce the number of staff he brought to the show by 20 percent from 2007. That drop from about 1,200 to 1,000 staffers meant an estimated savings of $120,000 or more a day. "We could now predict how the pipeline of people moved in the booth," Masters says, "and be sure we had exactly the right number of staff in exactly the right place at exactly the right times."

Even with management acknowledging his success in 2007, Masters didn't put his program on cruise control. While he collected the same 35 or so variables at the 2008 show as he did at the 2007 one, his quest to extract useful information from raw data was ongoing, even if it required happy hour to accomplish it. One night, after a round of drinks with Skip Cox of Exhibit Surveys Inc. and Art Borrego of Alliance Tech at the Corporate Event Marketing Association (CEMA) 2008 Summit in Las Vegas, Masters brought in the Red Bank, NJ-based research firm to formulate six- to eight-minute-long "intercept" surveys. Philips staff asked attendees the in-depth survey questions, with Exhibit Surveys later collating the survey findings with RFID data. Masters also used the surveys to help calculate Philips' net promoter score (NPS). A term minted by Fred Reichheld in his book "The Ultimate Question," NPS measures how your customers have become evangelists for your brand. Even with management acknowledging his success in 2007, Masters didn't put his program on cruise control. While he collected the same 35 or so variables at the 2008 show as he did at the 2007 one, his quest to extract useful information from raw data was ongoing, even if it required happy hour to accomplish it. One night, after a round of drinks with Skip Cox of Exhibit Surveys Inc. and Art Borrego of Alliance Tech at the Corporate Event Marketing Association (CEMA) 2008 Summit in Las Vegas, Masters brought in the Red Bank, NJ-based research firm to formulate six- to eight-minute-long "intercept" surveys. Philips staff asked attendees the in-depth survey questions, with Exhibit Surveys later collating the survey findings with RFID data. Masters also used the surveys to help calculate Philips' net promoter score (NPS). A term minted by Fred Reichheld in his book "The Ultimate Question," NPS measures how your customers have become evangelists for your brand.

Added to that, Masters directed an unnamed partner company to create a proprietary visualization program that allowed him to monitor what the RFID antennae were picking up in real time. Called a "dashboard," the program displayed data on a monitor in a staff-only room close to the booth. Masters could find out not only the number of radiologists that, say, were visiting the exhibit at any given time, but which institutions they represented, how many stops they made, and the duration of each visit in real time, in an easily visualized format right as it was happening. Even though professional attendance that year dropped almost 3.2 percent to 24,427, the exhibit drew 9,845 unique visitors, perhaps 10 percent more than 2007, with 52 percent of all Philips' attendees reporting a high purchasing intent.

Similar to 2007, after the show Masters was able to demonstrate to management through the at-show and post-show surveys how well Philips communicated key messages, how staffing tactics and product demonstrations would likely correlate to future purchases based on the 2007 baseline, and how high an NPS the company had racked up.

The Relentless Pursuit of Information

But as the 2009 RSNA show neared, Masters faced what might have been his greatest challenge. With the longest downturn since the Great Depression grinding the economy like a pepper mill, management turned a shrink ray on the booth, reducing the exhibit by 25 percent to 24,000 square feet, and cutting staff numbers by 20 percent to 800 individuals. While other exhibit managers might have felt hobbled by the reductions, Masters felt empowered. Building on the data acquired over the last two years, he resolved to cover the 2009 show in greater depth than ever. Starting with new pre-show surveys sent to an attendee list, he gauged his target demographic's purchasing mood about two months before the show so as to contrast it with post-show buying attitudes.

To keep expenses tamped down, the team looked back on the wealth of RFID-generated traffic-flow info from previous years to make sure the products shipped to the show were the kind of equipment that would draw buyers, thus saving the company thousands in shipping and drayage. Using that same knowledge, the team placed the MRIs, nuclear-medicine equipment, and other products in the areas where he was sure they would have maximum effect. To keep expenses tamped down, the team looked back on the wealth of RFID-generated traffic-flow info from previous years to make sure the products shipped to the show were the kind of equipment that would draw buyers, thus saving the company thousands in shipping and drayage. Using that same knowledge, the team placed the MRIs, nuclear-medicine equipment, and other products in the areas where he was sure they would have maximum effect.

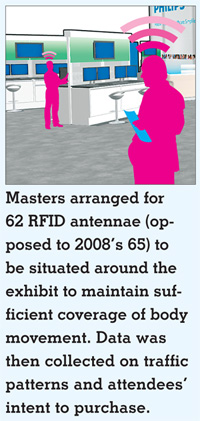

Then, despite the booth's substantially diminished size, Masters arranged for just slightly fewer RFID antennae (62, as opposed to 2008's 65) to be situated around the exhibit to maintain sufficient coverage of body movement. The day RSNA opened, Masters was back at the helm, collecting, analyzing, and reacting to the data almost as quickly as it came in to an updated version of dashboard from which he could now receive information from the lead-generation units' card swipes as well as the RFID tags. Now worn by more than 99 percent of attendees, the tags allowed the company to continue recording how many of the show's 35,110 professional visitors entered the exhibit, and where they spent most of their time, as well as the effectiveness of demonstrations and the popularity of new products.

Philips could also tabulate new information Masters has asked RSNA to include on registration data that would be available to the RFID systems including occupational subcategories

such as radiologists specializing in chest X-rays. Keeping an eye on the dashboard from the booth's back room, he diverted staff quickly to adapt to the ebb and flow of booth traffic. Using data from the 2008 show that indicated where and when international attendees flocked, Masters could allocate his staff (which spoke any of 10 languages) accordingly. Philips could also tabulate new information Masters has asked RSNA to include on registration data that would be available to the RFID systems including occupational subcategories

such as radiologists specializing in chest X-rays. Keeping an eye on the dashboard from the booth's back room, he diverted staff quickly to adapt to the ebb and flow of booth traffic. Using data from the 2008 show that indicated where and when international attendees flocked, Masters could allocate his staff (which spoke any of 10 languages) accordingly.

Besides measuring customers' general purchasing intent for its products as it had the two previous years, Philips tried to more specifically calculate the dollar volume of planned purchases, and therefore the potential return on opportunity (ROO), as the company called it, based on in-booth surveys. Survey staff using handheld electronic-survey units polled attendees to determine, among other data, the NPS, hoping that the changes made in the booth derived from data collected during previous shows - e.g., better product placement, more responsive staffing - would in turn raise the NPS, which Cox and others claim should have a direct correlation to future sales.

A Second Set of Eyes

When RSNA 2009 shut down, the event team passed on to the sales leadership finely parsed results that showed which specific attendees were most interested in what particular equipment. With the help of card swipes, intercepts, at- and

post-show surveys, and of course RFID - which Masters refers to as "My second set of eyes" - his report to management included an oil gusher of data. For example, the report included minute-by-minute booth-traffic patterns throughout the day; a breakdown of visitors by institution, position, and geography, matched against where they wandered in the booth and how long they spent at each location; attendees' intent to purchase correlated by job, product type, and areas visited; and even how attendees' behavior in the booth correlated to Philips' NPS. And that was just the tip of the iceberg.

While Masters doesn't stray far from his lip-locked, silence-is-golden attitude, he does reveal that RFID-enhanced data helped lead to the company saving thousands in staff costs and equipment shipping, raised the company's NPS, and may have even shortened the eons-long selling cycle at RSNA. Astoundingly, it also assisted in creating a knockout ROO at RSNA of 20 to 1. That means if the exhibit cost Philips $2 million, say, it earned back $40 million in show-related sales opportunities. While some may quibble that not everyone can afford RFID, the rapidly receding costs of the technology and its near-infinite uses suggest that the future belongs to those who, like Masters, take extreme measures to, well, measure what goes on in their booths. With Philips management expanding his 2010 booth at RSNA back to 32,000 square feet, and maintaining his budget while he delivers record results and unprecedented depths of information, Jeffrey Masters has proven himself a veritable master of exhibit management. E

|

lbert Einstein once said, "Not everything that can be counted counts, and not everything that counts can be counted." But the Nobel laureate who was hailed as the father of modern physics couldn't have been more wrong - and Jeffrey Masters of Philips Healthcare proved it with what one of our All-Star Awards judges called "A powerful, impactful

program that produced the kind of data management face-to-face marketers dream about."

lbert Einstein once said, "Not everything that can be counted counts, and not everything that counts can be counted." But the Nobel laureate who was hailed as the father of modern physics couldn't have been more wrong - and Jeffrey Masters of Philips Healthcare proved it with what one of our All-Star Awards judges called "A powerful, impactful

program that produced the kind of data management face-to-face marketers dream about." Accomplishing this feat would be difficult under any circumstances, but with the company's antiquated approach to measurement - post-show reports were based on a meager combination of perfunctory surveys and card swipes that gleaned only attendees' names and organizations - it was like asking the United States Census Bureau to keep track of America's millions with an abacus. The skeletal metrics were frustratingly nebulous for an $11-billion company that manufactures medical technology, from magnetic resonance imaging (MRI) to computed tomography (CT). "We were measuring ghosts," Masters says, "things you couldn't really get your hands around and make concrete conclusions about."

Accomplishing this feat would be difficult under any circumstances, but with the company's antiquated approach to measurement - post-show reports were based on a meager combination of perfunctory surveys and card swipes that gleaned only attendees' names and organizations - it was like asking the United States Census Bureau to keep track of America's millions with an abacus. The skeletal metrics were frustratingly nebulous for an $11-billion company that manufactures medical technology, from magnetic resonance imaging (MRI) to computed tomography (CT). "We were measuring ghosts," Masters says, "things you couldn't really get your hands around and make concrete conclusions about."  Scrambling together a plan in less than a month, Masters' strategy was to mix what he dubbed a "measurement cocktail" by blending data from multiple sources: interviews with booth visitors, information collected by RSNA show management, and a post-show survey of booth visitors 60 days after RSNA rolled up the carpets and shut the doors. At that point, Masters would gather the data, evaluate and graph it, and then deliver a comprehensive report to management projecting what attendees planned to purchase.

Scrambling together a plan in less than a month, Masters' strategy was to mix what he dubbed a "measurement cocktail" by blending data from multiple sources: interviews with booth visitors, information collected by RSNA show management, and a post-show survey of booth visitors 60 days after RSNA rolled up the carpets and shut the doors. At that point, Masters would gather the data, evaluate and graph it, and then deliver a comprehensive report to management projecting what attendees planned to purchase.  Tag, You're It

Tag, You're It Designed by the Atlanta division of exhibit and event firm Czarnowski Inc., Philips' 28,000-square-foot booth was divided into about 15 imaging-product areas, such as nuclear medicine and ultrasound, to attract its core target of radiology-department administrators, radiologists, and senior technicians in the field. Once a visitor entered the booth, one of the more than 1,200 staff (who were outfitted with generic RFID tags to monitor their behavior) swiped badges in the various product areas to generate leads, which were passed on to sales. Often through a brief conversation, staff might qualify the prospects who openly expressed an interest in purchasing - or a lack thereof - as hot, medium, or cold. The flesh-and-blood interaction was overshadowed, however, by the RFID surveillance. Setting up 25 data-collection antennae near the product stations around the booth that could pick up signals from attendees' badges

up to 16 feet away, Philips stealthily logged where visitors went and how long they stayed, among the approximately 35 variables it tracked.

Designed by the Atlanta division of exhibit and event firm Czarnowski Inc., Philips' 28,000-square-foot booth was divided into about 15 imaging-product areas, such as nuclear medicine and ultrasound, to attract its core target of radiology-department administrators, radiologists, and senior technicians in the field. Once a visitor entered the booth, one of the more than 1,200 staff (who were outfitted with generic RFID tags to monitor their behavior) swiped badges in the various product areas to generate leads, which were passed on to sales. Often through a brief conversation, staff might qualify the prospects who openly expressed an interest in purchasing - or a lack thereof - as hot, medium, or cold. The flesh-and-blood interaction was overshadowed, however, by the RFID surveillance. Setting up 25 data-collection antennae near the product stations around the booth that could pick up signals from attendees' badges

up to 16 feet away, Philips stealthily logged where visitors went and how long they stayed, among the approximately 35 variables it tracked.  grand total of nearly 27,000 times, with some staying as little as 30 seconds while others loitered as long as 123 minutes. When breast radiologists from the University of Chicago Hospitals

strolled through the MRI area, for

instance, Masters could note how much time they spent watching a demonstration of MammoTrak, the portable breast MRI trolley Philips debuted at the show.

grand total of nearly 27,000 times, with some staying as little as 30 seconds while others loitered as long as 123 minutes. When breast radiologists from the University of Chicago Hospitals

strolled through the MRI area, for

instance, Masters could note how much time they spent watching a demonstration of MammoTrak, the portable breast MRI trolley Philips debuted at the show.  Even with management acknowledging his success in 2007, Masters didn't put his program on cruise control. While he collected the same 35 or so variables at the 2008 show as he did at the 2007 one, his quest to extract useful information from raw data was ongoing, even if it required happy hour to accomplish it. One night, after a round of drinks with Skip Cox of Exhibit Surveys Inc. and Art Borrego of Alliance Tech at the Corporate Event Marketing Association (CEMA) 2008 Summit in Las Vegas, Masters brought in the Red Bank, NJ-based research firm to formulate six- to eight-minute-long "intercept" surveys. Philips staff asked attendees the in-depth survey questions, with Exhibit Surveys later collating the survey findings with RFID data. Masters also used the surveys to help calculate Philips' net promoter score (NPS). A term minted by Fred Reichheld in his book "The Ultimate Question," NPS measures how your customers have become evangelists for your brand.

Even with management acknowledging his success in 2007, Masters didn't put his program on cruise control. While he collected the same 35 or so variables at the 2008 show as he did at the 2007 one, his quest to extract useful information from raw data was ongoing, even if it required happy hour to accomplish it. One night, after a round of drinks with Skip Cox of Exhibit Surveys Inc. and Art Borrego of Alliance Tech at the Corporate Event Marketing Association (CEMA) 2008 Summit in Las Vegas, Masters brought in the Red Bank, NJ-based research firm to formulate six- to eight-minute-long "intercept" surveys. Philips staff asked attendees the in-depth survey questions, with Exhibit Surveys later collating the survey findings with RFID data. Masters also used the surveys to help calculate Philips' net promoter score (NPS). A term minted by Fred Reichheld in his book "The Ultimate Question," NPS measures how your customers have become evangelists for your brand. To keep expenses tamped down, the team looked back on the wealth of RFID-generated traffic-flow info from previous years to make sure the products shipped to the show were the kind of equipment that would draw buyers, thus saving the company thousands in shipping and drayage. Using that same knowledge, the team placed the MRIs, nuclear-medicine equipment, and other products in the areas where he was sure they would have maximum effect.

To keep expenses tamped down, the team looked back on the wealth of RFID-generated traffic-flow info from previous years to make sure the products shipped to the show were the kind of equipment that would draw buyers, thus saving the company thousands in shipping and drayage. Using that same knowledge, the team placed the MRIs, nuclear-medicine equipment, and other products in the areas where he was sure they would have maximum effect.  Philips could also tabulate new information Masters has asked RSNA to include on registration data that would be available to the RFID systems including occupational subcategories

such as radiologists specializing in chest X-rays. Keeping an eye on the dashboard from the booth's back room, he diverted staff quickly to adapt to the ebb and flow of booth traffic. Using data from the 2008 show that indicated where and when international attendees flocked, Masters could allocate his staff (which spoke any of 10 languages) accordingly.

Philips could also tabulate new information Masters has asked RSNA to include on registration data that would be available to the RFID systems including occupational subcategories

such as radiologists specializing in chest X-rays. Keeping an eye on the dashboard from the booth's back room, he diverted staff quickly to adapt to the ebb and flow of booth traffic. Using data from the 2008 show that indicated where and when international attendees flocked, Masters could allocate his staff (which spoke any of 10 languages) accordingly.