measurement |

|

or many exhibitors, trade show audits and surveys are about as exciting as K-Fed sightings. After all, these Mojave-dry reports contain little more than attendee data and demographics, which don't exactly make for titillating water-cooler conversation. or many exhibitors, trade show audits and surveys are about as exciting as K-Fed sightings. After all, these Mojave-dry reports contain little more than attendee data and demographics, which don't exactly make for titillating water-cooler conversation.

But according to exhibitors such as Glenda Brungardt, trade show/event manager for Hewlett-Packard Development Co. L.P., this ho-hum reaction has less to do with audits and surveys and more to do with exhibitors' knowledge of them. If exhibitors understood how audits and surveys can help them plan and improve their exhibit programs, she asserts, they'd trade their yawns for cartwheels.

So what are these misunderstood reports, and how can you use them to improve and justify your exhibit program? Here's the least you should know about audits and surveys, along with four practical applications.

Audits and Surveys Illuminated

|

Certified-Audit Data Availability

To gauge our readers' knowledge and use of audits and surveys, we queried roughly 336 readers using an e-mail delivery survey. See how your answers stack up to the questions below as well as those on page 26 and 28.

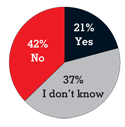

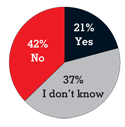

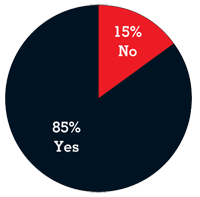

Do you know the difference between a certified trade show audit and a survey?

Do you understand all of the benefits that certified audits offer your exhibit-marketing program?

|

|

Simply put, an audit is a certified, third-party report that verifies a show's attendance figures and demographics. To complete an audit, a show organizer hires one of three independent, third-party auditors: Business Publications Auditing Worldwide (BPA), Veris Consulting LLC, or Exhibit Surveys Inc., each of which is certified by The Exhibition & Event Industry Audit Council (EEIAC), an independent organization that certifies audits and monitors audit standards.

The auditor samples the show's registration database and contacts attendees to validate attendance and demographic data. The auditor then prepares a report indicating the show's certified attendance and demographic figures.

While audits and surveys are often used together, they're completely different animals. As with audits, show organizers initiate surveys; however, surveys can be executed by the show organizer or by a market-research firm, so they're not certified, and might not be completed by a third-party firm.

A survey, then, provides additional information beyond what is typically requested on a registration form. The company executing the survey poses questions - regarding everything from audience quality to show promotion - to some of the attendees and prepares a report of the results. "A survey can tell you everything from how much time attendees spent in exhibits, to what products they were most interested in," says Skip Cox, president and CEO of Exhibit Surveys.

Cox also points out that audits are census based, meaning that everything and everyone is counted and verified, whereas surveys only represent a sample of the audience. And when used in conjunction with an audit, the preferences, opinions, and activities of that sample are projected out onto the entire audited attendee base.

In addition, there is an audit/survey hybrid developed via a partnership between BPA and Exhibit Surveys, which combines the audit and survey data into a single, relatively easy-to-peruse report.

So what's the point of all of this data? "The most important benefit of audits and surveys is that they take the whole question of accurate attendance figures off the table," Cox says. "They not only raise exhibitors' trust in an audited show, they raise the entire confidence level of the industry."

For Brungardt, increased trust equates to increased or continued investments in the show. "A third-party audit gives me confidence that show management is delivering the size and quality of audience it sold me on; whereas unaudited shows allow me to assume that the published attendance figures are inflated and demographics are inaccurate," she says. "Thus, I am more likely to purchase promotions and sponsorships when the show's attendance numbers are substantiated by an audit and survey."

While verified attendance figures and accurate demographics are primary benefits, audits and surveys provide myriad ancillary benefits to exhibitors, allowing them to plan more effective programs, to better allocate their budgets, to meet the needs of their audience, and to better measure the effectiveness of their programs.

There is, however, a fly in this ointment: Show organizers, rather than exhibitors, fund and initiate audits and surveys, and only an estimated 1 percent of shows provide audits and surveys for their exhibitors. According to Cox, this statistic isn't about organizers wanting to hide their numbers, and it's not that organizers can't afford them - he says an audit only costs $5,200, and an audit/survey package ranges between $10,700 to $12,800, depending on whether the survey is conducted online or by mail. Rather, Cox says, organizers' reluctance to provide audits and surveys is all about lack of demand.

"When we ask show organizers why they aren't offering audits, they tell us exhibitors aren't asking for them," Cox says. "An audit requires manpower, time, and energy. So they figure if there's no demand from exhibitors, why bother?"

One of the first exhibitor-led associations to demand that management "bother" with audits was the Corporate Event Marketing Association (previously the Computer Event Marketing Association). When EXHIBITOR first broached the subject of audits in August 2001, CEMA had recently issued a statement endorsing third-party audits. Since then, CEMA members have consistently asked for audits, thereby raising demand to the point that approximately two-thirds of all major information-technology trade shows now conduct independent audits.

Whether you choose to ask your show organizers for audits and surveys is up to you. But before you choose not to act, you should at least know what you're missing. Here, then, are four simple ways to use audit and survey data to improve your program.

Four Ways to Use Audits and Surveys

The calculations below use figures found in an audit/survey

hybrid for the Linux World Conference

and Expo 2006, which is available at www.ExhibitorWebLinks.com. Our calculation examples assume the exhibiting company offers server and server-management software.

|

"When show organizers don't do audits, the problem isn't really the lack of attendance and demographic information, it's that I don't believe the numbers they put in front of me because they are not certified," says  Marilyn Kroner, president of trade show consulting firm Kroner Communications and CEMA's 2001 president. "And if I can't believe general attendance numbers, I surely can't believe numbers specific to my target audience. That means I don't know exactly how many attendees are really interested in my products and fit my targeted profile - and that makes planning nearly impossible." Marilyn Kroner, president of trade show consulting firm Kroner Communications and CEMA's 2001 president. "And if I can't believe general attendance numbers, I surely can't believe numbers specific to my target audience. That means I don't know exactly how many attendees are really interested in my products and fit my targeted profile - and that makes planning nearly impossible."

Granted, most show organizers don't inflate their attendance numbers. However, an audit eliminates the attendance-inflation issue altogether and provides accurate data to help you determine the true size of your Potential Audience.

Armed with Potential-Audience data, you can not only decide whether you should be exhibiting at this show, but also what size investment the show warrants and the type of marketing strategy that will best reach this audience. Monitoring audience size and demographic information over time can also alert you to changes in the "health" of the show and any shifts in audience demographics.

Calculation

To determine the size of your Potential Audience at the show, review the Job Function categories (such as CEO, R&D/Scientific, Programmer/Developer, etc.) and Primary Business/Industry categories (such as Healthcare-Medical, Marketing-Sales, Education) found in the audit/survey. Then add up the number of attendees that fit your target profile. In our example, the exhibitor provides server and server-management software, and the sum of its targeted attendees is 1,776. (See p. 2 and 3 of the online survey.)

Identify the percentage of attendees that are interested in your product or service. For our example, 40 percent of attendees indicated they were interested in server and server management. (See p. 6 of the online survey.)

Multiply the sum of your targeted attendees by the percentage of attendees interested in your product to determine your total Potential Audience, which in this case is 710 out of the show's 3,781 Net Attendance, including conference and exhibit-only attendees and excluding exhibitors, journalists, show organizers, speakers, etc. (See p. 1 of the online survey.)

| |

Sum of targeted attendees |

1,776 |

| |

Percentage of attendees interested in your product |

x 40% |

| |

|

| |

Potential Audience |

710 |

|

APPLICATION AND ADVICE:

POTENTIAL AUDIENCE

Once you've run the numbers, consider the following tips as you apply your newfound knowledge to your program.

. The first question you need to ask is: Does the potential to reach up to 710 people justify participation in the show? If so, ask yourself: How do I reach these 710 people in a sea of 3,781? In this case, your booth strategy needs selective attraction, not mass attraction. Without an audit/survey, you'd know little more than the attendance figure, which may or may not be accurate.

. "The size of your Potential Audience as it relates to Net Attendance determines whether you belong at the show," Cox says. "If your Potential Audience comprises only a very small percentage of the Net Attendance, it's time to seriously question your participation."

. "Product Interest is key to determining how many of your targeted attendees will actually stop by your booth," Cox says. For example, if someone in your target audience has no interest in seeing your category of products, then this person will be very difficult to attract.

. "People aren't often at the wrong show, but they've often over- or under-invested in it, relative to the size and value of their Potential Audience," Cox says.

|

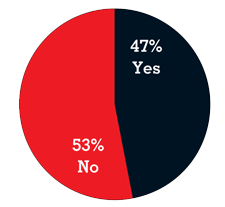

Is the information provided in the certified audit helpful to you when deciding whether or not to exhibit at a show?

|

Once you've calculated your Potential Audience, you can determine how to best attract these people to your booth (Do you need selective- or mass-attraction activities, for example?) and how many staffers you will need.

Since face-to-face interaction is paramount to exhibit marketing, Cox suggests you first determine the number of staffers necessary to meet your goals and then determine the size of the booth space necessary to accommodate those staffers along with your Potential Audience and exhibitry.

Calculations

To determine how many staffers you will need in your booth, divide your Potential Audience by the number of hours (20 in our example) the exhibit hall is open to determine the average number of visitors you can expect to visit your booth each hour.

| |

Potential Audience |

710 |

| |

Hours the show is open |

÷ 20 |

| |

|

| |

Average number of booth visitors per hour |

36 |

Next, divide the average number of booth visitors per hour by the number of attendees each staffer can speak with per hour based on your experience (in our case, seven). To establish a benchmark for this number, you can ask staffers to count the number of attendees they speak with during various one-hour intervals at your next show - and then determine their visitor-per-hour average. Or if almost all visitors are tracked via a lead-processing system, you can divide your leads by the number of staffers to get a rough estimate. If you don't have a benchmark for your staffers' level of performance, Cox suggests you use the industry average of 10 visitors per staffer per hour, assuming staffers can talk with more than one person per conversation. Next, divide the average number of booth visitors per hour by the number of attendees each staffer can speak with per hour based on your experience (in our case, seven). To establish a benchmark for this number, you can ask staffers to count the number of attendees they speak with during various one-hour intervals at your next show - and then determine their visitor-per-hour average. Or if almost all visitors are tracked via a lead-processing system, you can divide your leads by the number of staffers to get a rough estimate. If you don't have a benchmark for your staffers' level of performance, Cox suggests you use the industry average of 10 visitors per staffer per hour, assuming staffers can talk with more than one person per conversation.

| |

Average number of

booth visitors per hour |

36 |

| |

Number of attendees staffers can handle per hour |

÷ 7 |

| |

|

| |

Staffers needed |

5.1 |

|

APPLICATION AND ADVICE: STAFF

In trade shows and in life, myriad variations can affect the outcome of just about any situation. So consider Cox's guidelines before setting your staffing schedule.

. When determining the number of attendees each staffer can handle per hour, consider variations such as complex products that require lengthy explanations, high-traffic demos or giveaways that will draw additional unqualified traffic, and attendance fluctuations throughout the show.

. Just because an attendee makes it to a booth doesn't mean he or she was engaged with the company's staff or products. In fact, according to Cox, the Staff-Interaction Rate, the average percentage of attendees that interact with staffers, has dropped from 67 percent in 1993 to 61 percent in 2007. "Engagement rates are partially a function of having the right number of staffers in your booth," Cox says. "So when you're trying to determine staff size, always consider how many are necessary to effectively engage attendees."

. "This drop in Staff-Interaction Rates doesn't mean exhibitors aren't doing a good job of attracting people to the booth," Cox says. "But they're not closing the loop to engage them, and a lot of that is because there aren't enough staffers. Attraction rates haven't dropped, but companies are bringing fewer staffers to the show relative to the size of their Potential Audience."

|

|

Online Resource

Exhibit Surveys has created an online tool to allow exhibit managers to perform many of these calculations. While you'll still need audit data, the online tool will quickly calculate figures such as Potential Audience. To use the tool, visit www.roitoolkit.exhibitsurveys.net.

|

Working back from the number of staffers necessary to attract and engage your Potential Audience, your next step is to determine the size of booth space

you'll need to house staffers, attendees, and your exhibitry, products, etc.

Cox's research shows that a good rule of thumb for effective booth communication is one staffer for every 50 square feet of open exhibit space, i.e. space not occupied by exhibitry.

Calculations

If you've determined you need five people to staff your booth, multiply five by 50 square feet to determine the amount of open space you'll need.

| |

Staffers |

5 |

| |

Square feet of open space required/staffer |

x 50 |

| |

|

| |

Square feet of open booth space |

250 |

Next, determine how much total space you need. Estimate or measure your occupied square footage - the space occupied by your exhibitry, product displays, theater, storage, hospitality area, etc. In our example, occupied space is estimated at 150 square feet. Add your open space and occupied space to determine the total space you'll need for your booth.

| |

Open space |

250 |

| |

Occupied space |

+ 150 |

| |

|

| |

Square feet of booth space |

400 |

|

APPLICATION AND ADVICE:

BOOTH SIZE

While your suggested booth-space size is based on sound calculations, Cox argues that you can't rely on calculations alone when choosing your space size.

. "Use common sense when you determine your booth size," Cox says. "Let's say your calculations reveal that you need a 400-square-foot space, but you've only got the budget for a 100-square-foot space. You probably shouldn't blow your budget to size up to the bigger booth. Rather, stick with what you can realistically afford, but adjust your expectations accordingly for the number of your Potential Audience you can reach. Then, try to accommodate a larger booth space in your budget next year."

|

|

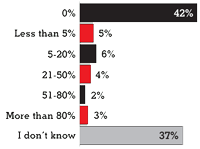

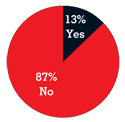

Does show management provide you with certified audit data for any of the shows you attend? Does show management provide you with certified audit data for any of the shows you attend?

If yes, what percentage of shows at which you exhibit provide certified, independently audited attendance figures?

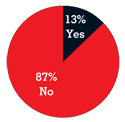

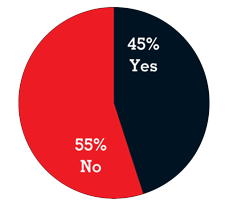

Have you requested certified audit data from show management or asked show management to conduct a certified audit of a particular show? Have you requested certified audit data from show management or asked show management to conduct a certified audit of a particular show?

|

Anybody can set random objectives for badge swipes, exhibit traffic, leads/inquiries, etc. However, unless you know your true Potential Audience, you can't really evaluate how well you're doing. For example, let's say you set a goal of 200 leads/inquiries, i.e. people who swipe their badge at the booth, but you actually gathered 300 leads/inquiries. Sure, you beat your goal, but is 300 good? Unless you know your Potential Audience, your 300 leads/inquiries have no context.

In addition to analyzing leads, you can also analyze staff performance. So let's say this exhibitor had three people on duty. If you take the 175 total leads/inquiries divided by the 20 hours the show is open, and then divide that by the three people they had on duty, the exhibitor had 2.9 inquiries per staff person per hour. By marking this data over time, you can track staff effectiveness.

Calculations

Let's say you collected a total of 175 leads/inquiries and 100 of them were qualified leads. If you divide the total number of qualified leads by your leads/inquiries, you can determine that 57 percent of the people you attracted to your booth were qualified.

| |

Qualified leads |

100 |

| |

Total leads/inquiries |

÷ 175 |

| |

|

| |

Percentage of leads/inquiries who were qualified leads |

57% |

To put those 175 leads/inquiries into context, you need to determine what percentage of your Potential Audience those 175 leads/inquiries represent. Divide your total leads/inquiries by your Potential Audience. (In calculation No. 1, we determined that the Potential Audience was 710.) Your answer is the percentage of your Potential Audience that you attracted to your booth.

| |

Total leads/inquiries |

175 |

| |

Potential Audience |

÷ 710 |

| |

|

| |

Percentage of Potential Audience attracted to your booth |

25% |

|

APPLICATION AND ADVICE: EXHIBIT PERFORMANCE

Cox offers insight into what percentage of your Potential Audience you can actually expect to attract to your exhibit.

. The chances of obtaining leads/inquiries or qualified leads from all 710 members of your Potential Audience are slim, and depending on countless variables such as the size of the show, your budget, exhibit size, etc., this 25 percent may be satisfactory. However, if you decide that capturing 25 percent of your Potential Audience is not enough, then you can take steps - additional promotions, a larger booth space, pre-set meetings, etc. - to increase this percentage.

. "Realistically, even if you attract all of your Potential Audience, capturing 50 percent as leads/inquiries is considered quite good," Cox says. "Getting one of every two attendees to somehow swipe their badge is a really good ratio. Most companies are getting one out of three. So don't expect to get 100 percent of your Potential Audience to swipe their badge at your booth."

. This calculation is key to understanding the show's potential. It not only tells you how well you're doing, but it shows you what you're missing, which in this case is 75 percent of your Potential Audience. |

Check for the Checkmark

How can you tell if an audit has been certified by the Exhibition & Event Industry Audit Commission (EEIAC)? Used since 2006, this checkmark

indicates the report is an independent EEIAC-certified audit.

|

|

|

or many exhibitors, trade show audits and surveys are about as exciting as K-Fed sightings. After all, these Mojave-dry reports contain little more than attendee data and demographics, which don't exactly make for titillating water-cooler conversation.

or many exhibitors, trade show audits and surveys are about as exciting as K-Fed sightings. After all, these Mojave-dry reports contain little more than attendee data and demographics, which don't exactly make for titillating water-cooler conversation.

Marilyn Kroner, president of trade show consulting firm Kroner Communications and CEMA's 2001 president. "And if I can't believe general attendance numbers, I surely can't believe numbers specific to my target audience. That means I don't know exactly how many attendees are really interested in my products and fit my targeted profile - and that makes planning nearly impossible."

Marilyn Kroner, president of trade show consulting firm Kroner Communications and CEMA's 2001 president. "And if I can't believe general attendance numbers, I surely can't believe numbers specific to my target audience. That means I don't know exactly how many attendees are really interested in my products and fit my targeted profile - and that makes planning nearly impossible."

Next, divide the average number of booth visitors per hour by the number of attendees each staffer can speak with per hour based on your experience (in our case, seven). To establish a benchmark for this number, you can ask staffers to count the number of attendees they speak with during various one-hour intervals at your next show - and then determine their visitor-per-hour average. Or if almost all visitors are tracked via a lead-processing system, you can divide your leads by the number of staffers to get a rough estimate. If you don't have a benchmark for your staffers' level of performance, Cox suggests you use the industry average of 10 visitors per staffer per hour, assuming staffers can talk with more than one person per conversation.

Next, divide the average number of booth visitors per hour by the number of attendees each staffer can speak with per hour based on your experience (in our case, seven). To establish a benchmark for this number, you can ask staffers to count the number of attendees they speak with during various one-hour intervals at your next show - and then determine their visitor-per-hour average. Or if almost all visitors are tracked via a lead-processing system, you can divide your leads by the number of staffers to get a rough estimate. If you don't have a benchmark for your staffers' level of performance, Cox suggests you use the industry average of 10 visitors per staffer per hour, assuming staffers can talk with more than one person per conversation.