|

REGISTRATION REQUIRED

research

Economic Outlook

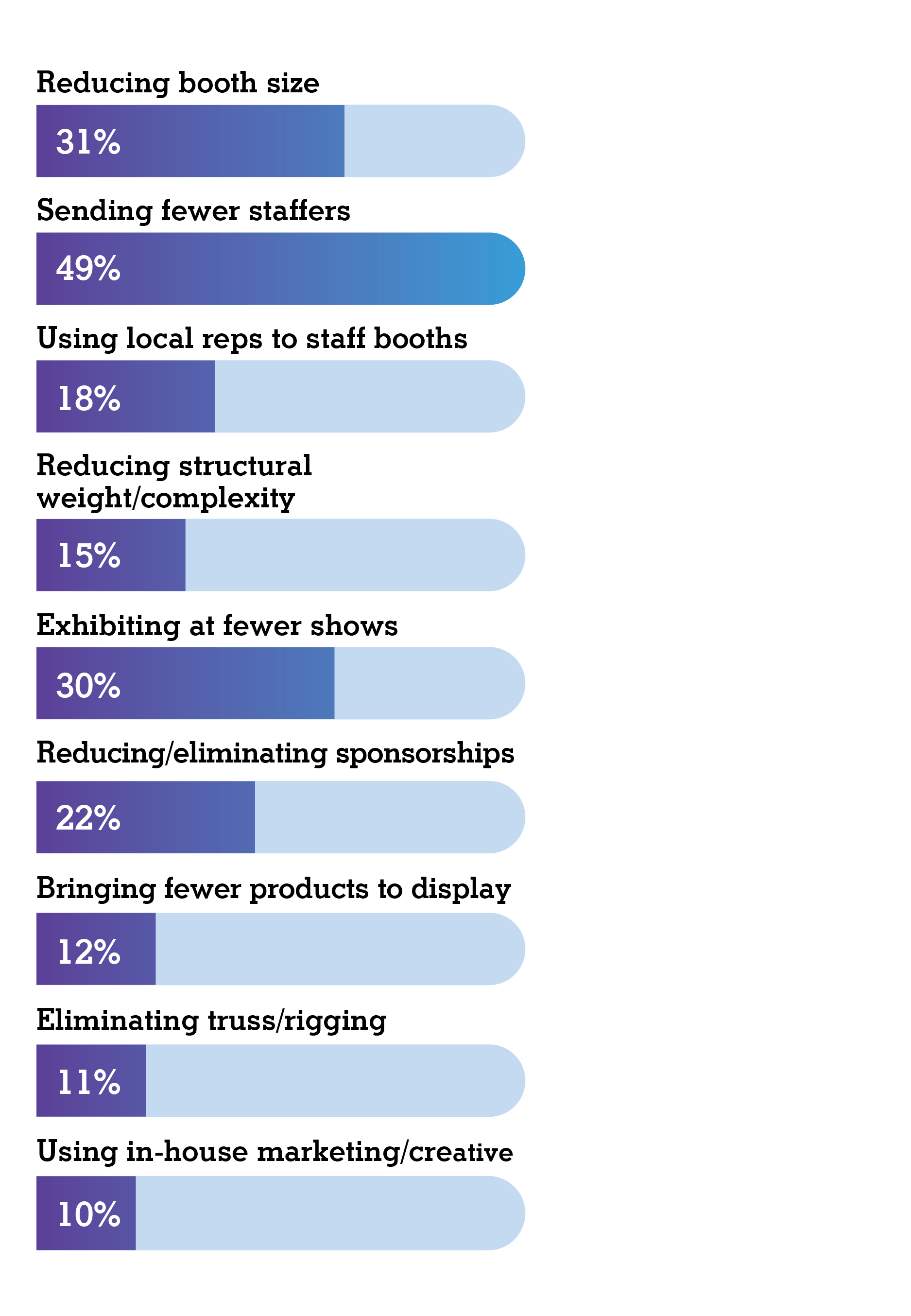

According to the results of EXHIBITOR's 2023 Economic Outlook Survey, budgets are back, and regional shows are booming. But we still have a ways to go if we hope to return to pre-COVID benchmarks. By Travis Stanton

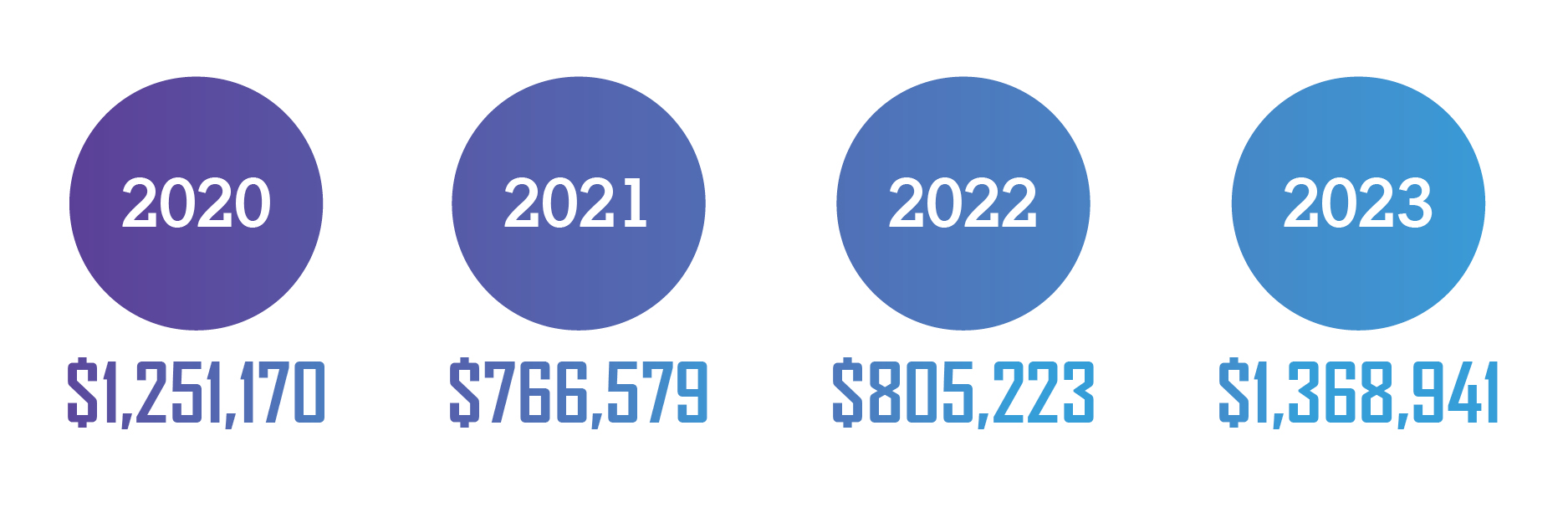

A little over three years ago, nobody had heard of COVID-19. And as the ball dropped and the industry looked ahead to 2020, few could have predicted that a global pandemic would pummel the face-to-face marketing ecosystem. In fact, EXHIBITOR Magazine's 2020 Economic Outlook Survey (fielded mere weeks before COVID-19 began impacting live trade shows and events) showed marketers planned to exhibit at 54 events that year, with an average trade show budget of $1.25 million. Just two months later, quarantines and cancellations left us wondering if we would ever return to "normal."

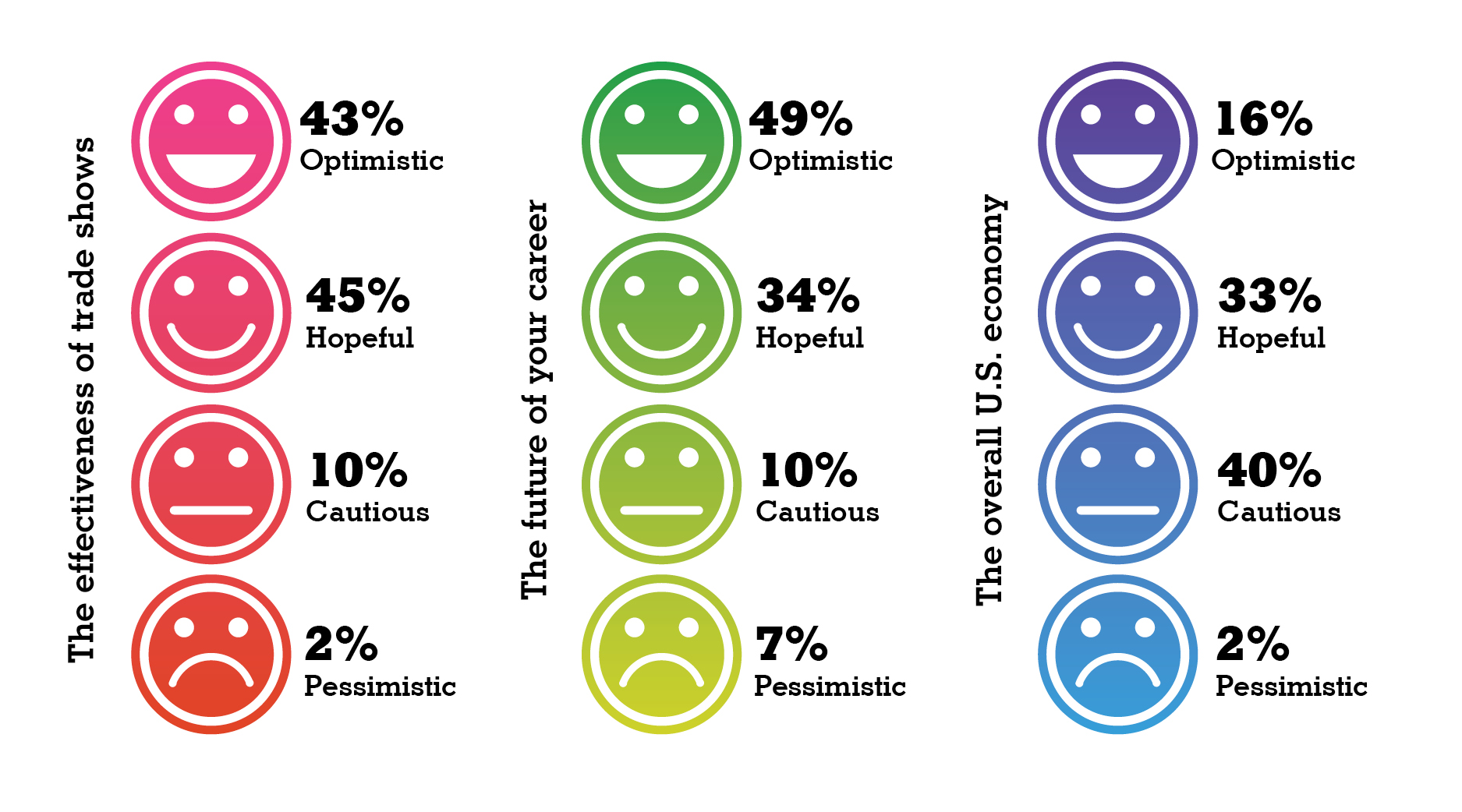

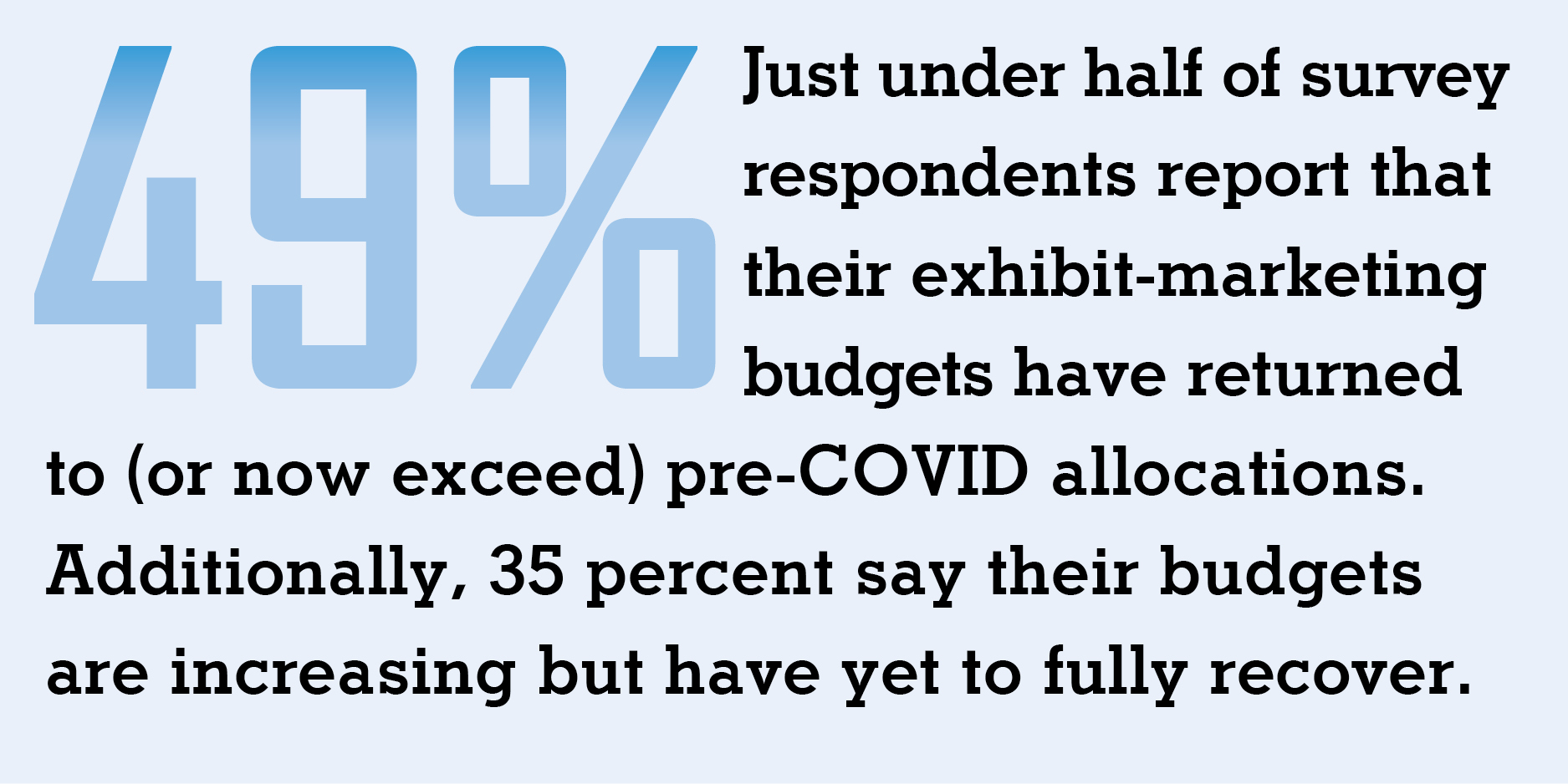

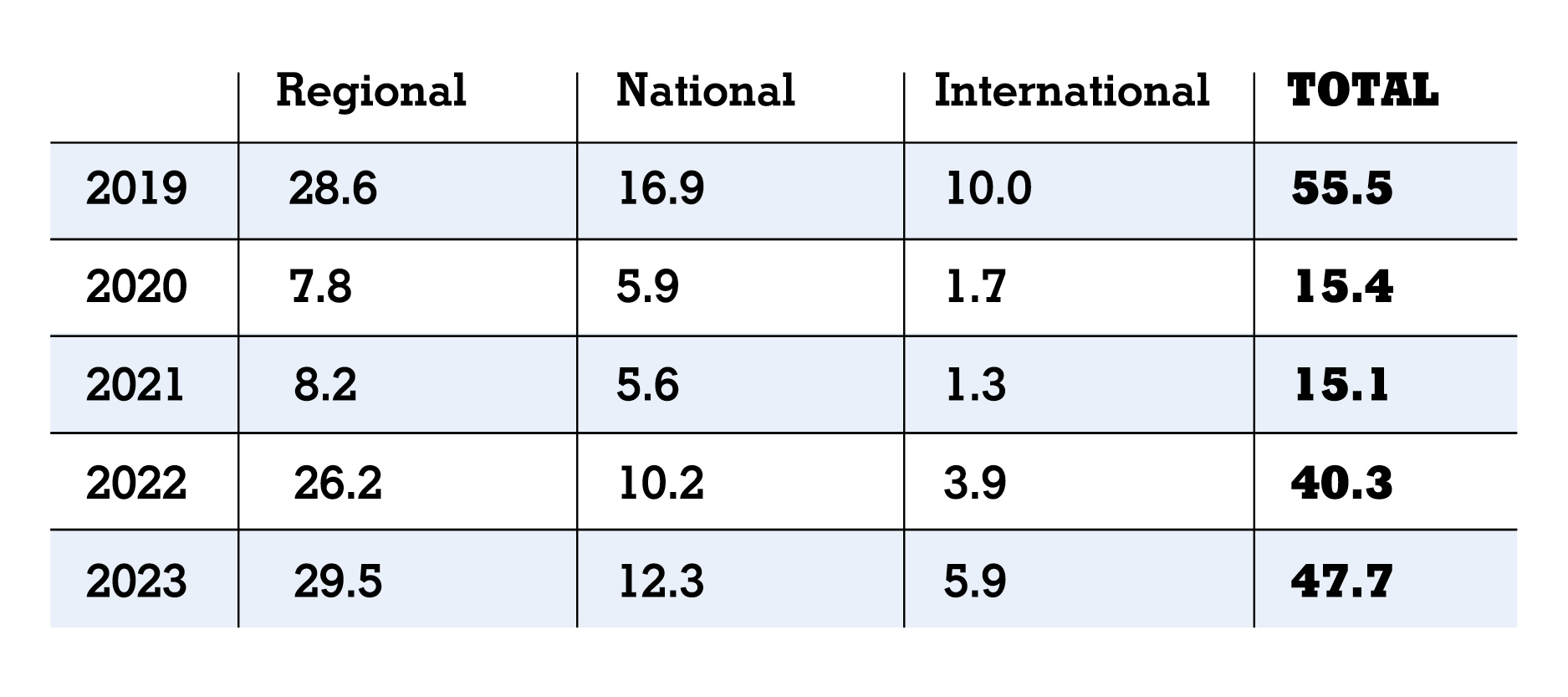

While it's difficult to believe how tumultuous the past 36 months have been, it's also incredible to see the resilience demonstrated by so many in our industry sector. Today, trade shows are forging ahead with ever-rising attendance figures, exhibit houses are buzzing with new business, and marketers are resuming more traditional event schedules. But precisely how far have we come in terms of industry recovery? And where do things stand in comparison to pre-COVID levels? Those are just some of the questions we sought to answer when conducting this year's Economic Outlook Survey. According to the data, budgets are back, sometimes even exceeding pre-COVID allocations. What's more, regional show participation now exceeds 2019 levels, and international exhibiting has resumed in earnest. And while the future is impossible to predict, the outlook is optimistic that our industry will continue to rebound and the power of trade shows will prevail – so long as the economy holds steady.

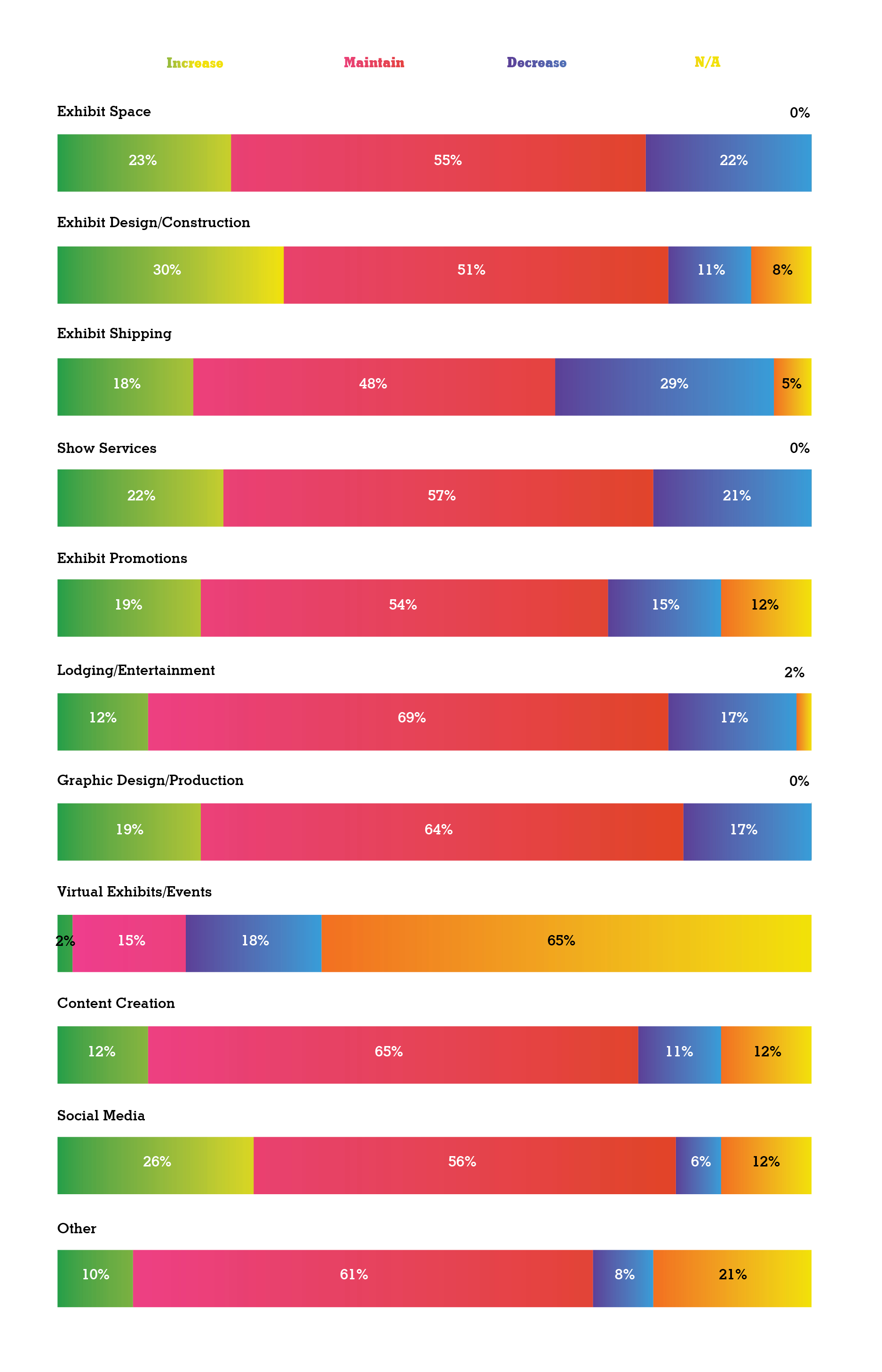

Does your organization plan to increase, maintain, or decrease spending on the following exhibit-related line items?

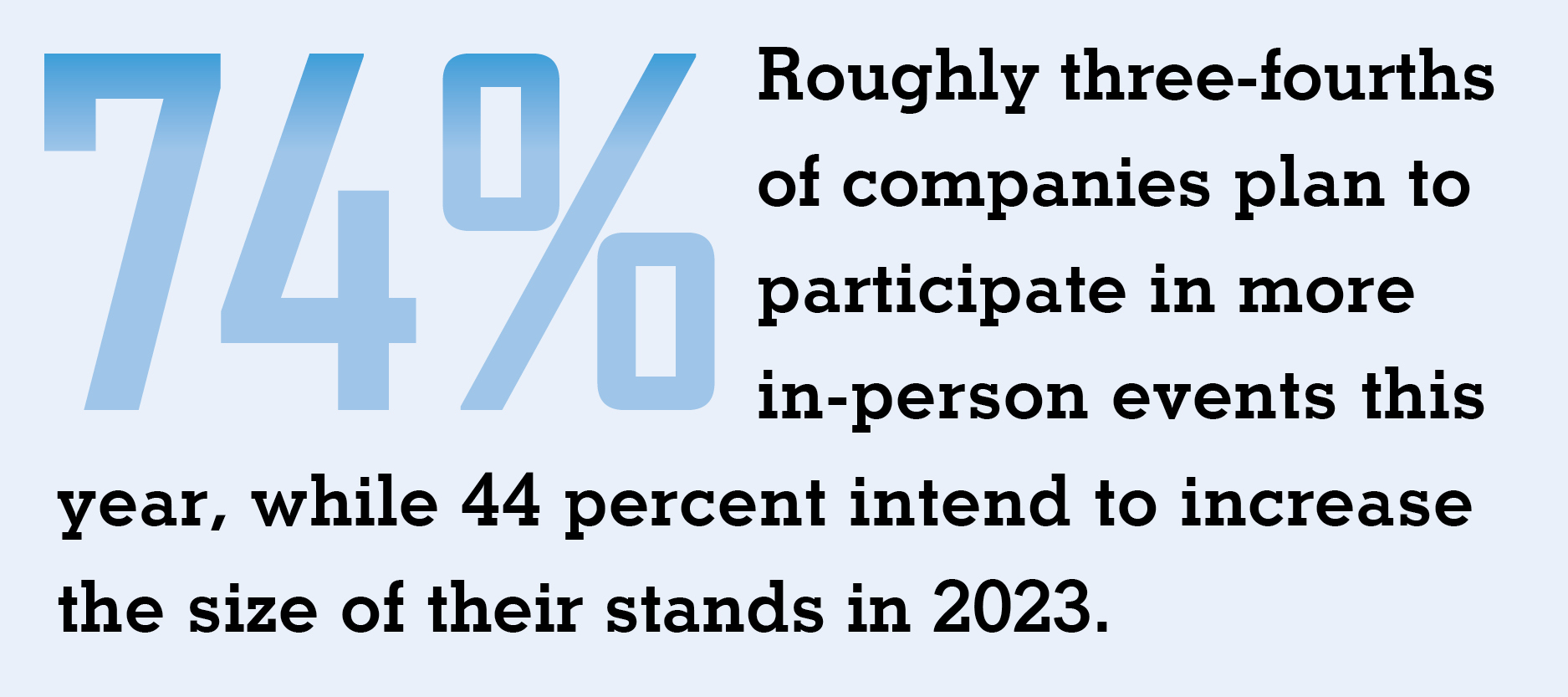

How would you characterize your feelings regarding the following?

If you intend to cut costs in 2023, which of the following options are you considering?

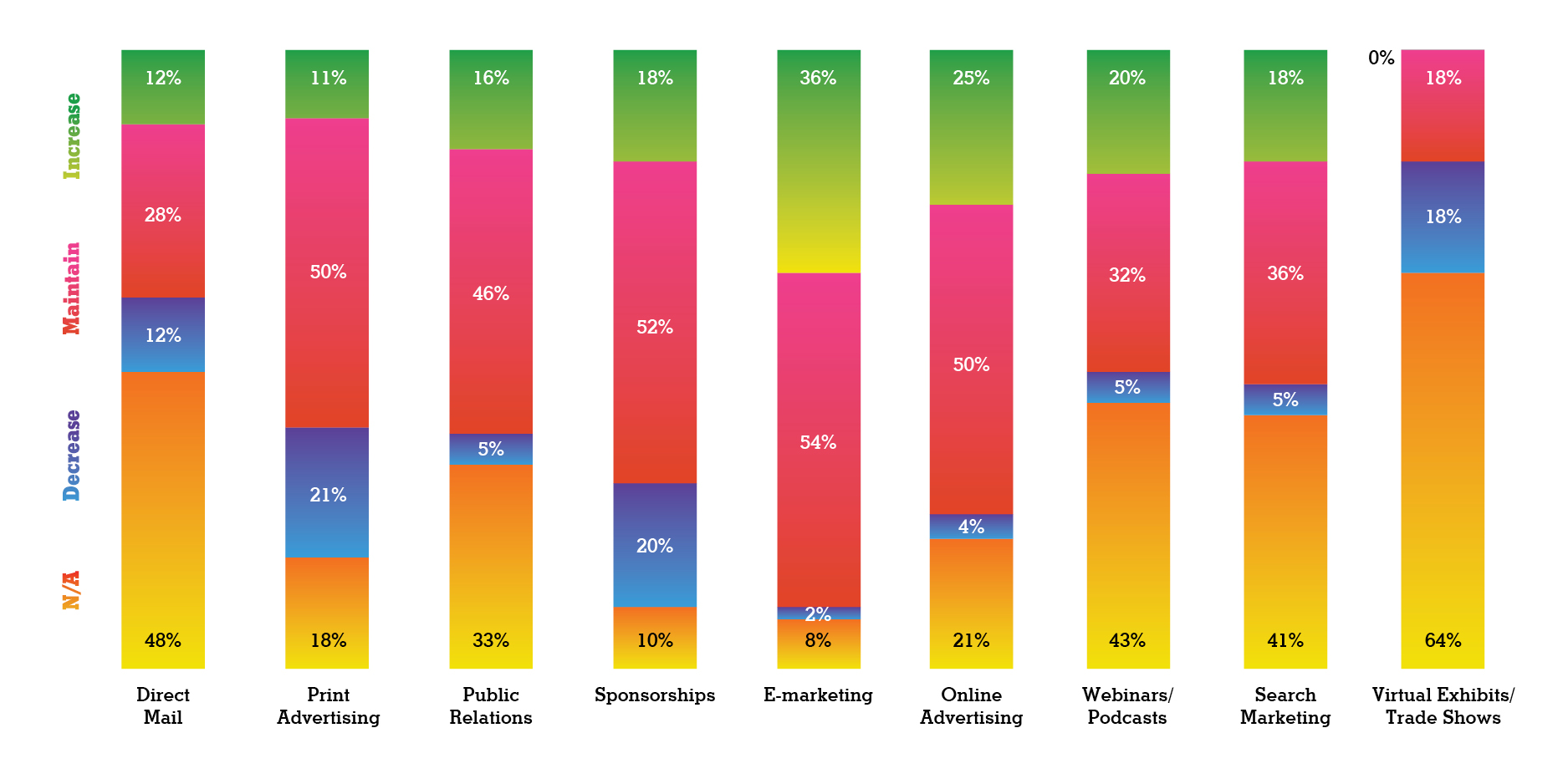

Does your organization plan to increase, maintain, or decrease spending on the following marketing channels in 2023?

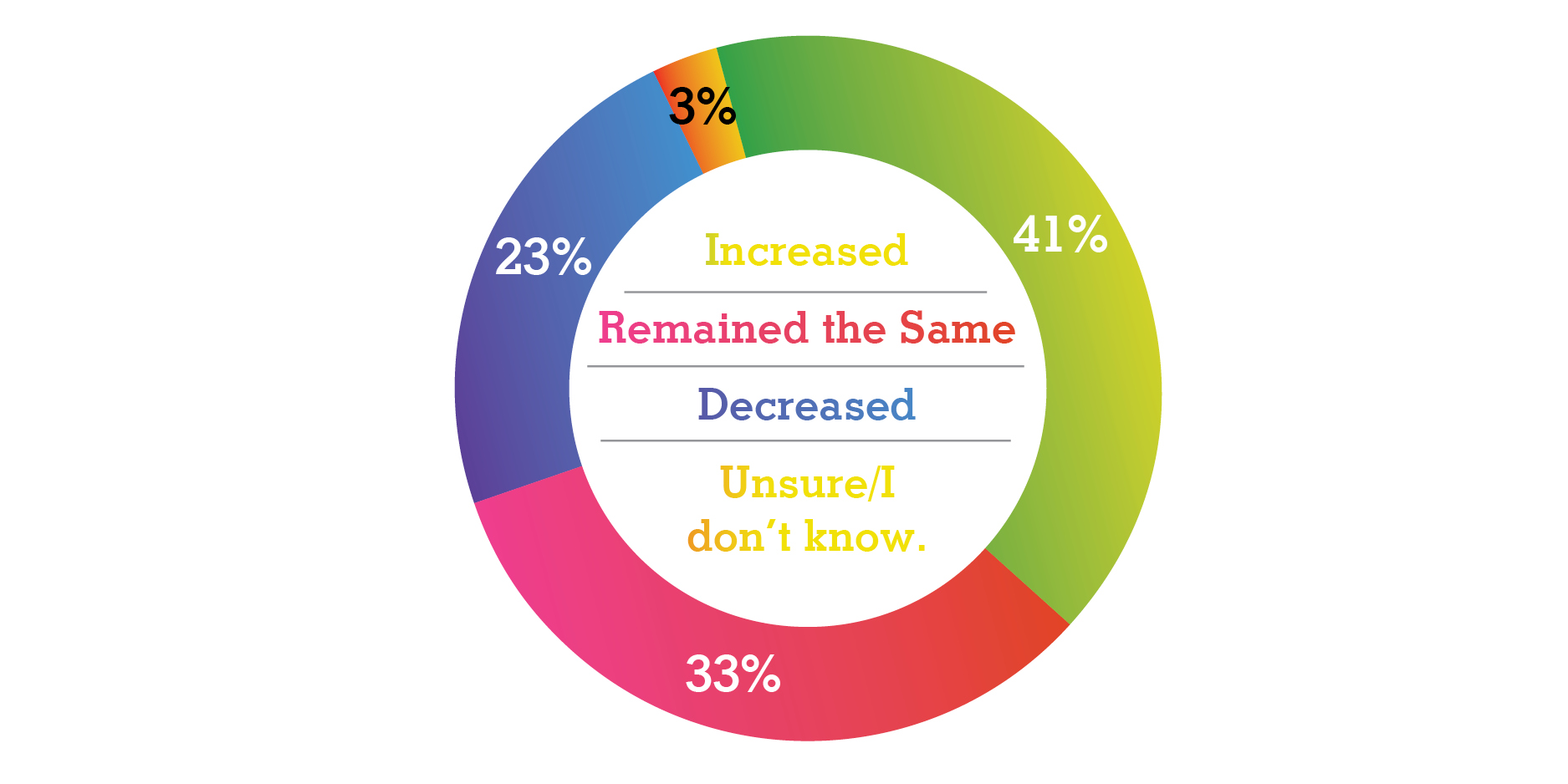

Has your exhibit-marketing budget increased, remained the same, or decreased compared to last year?

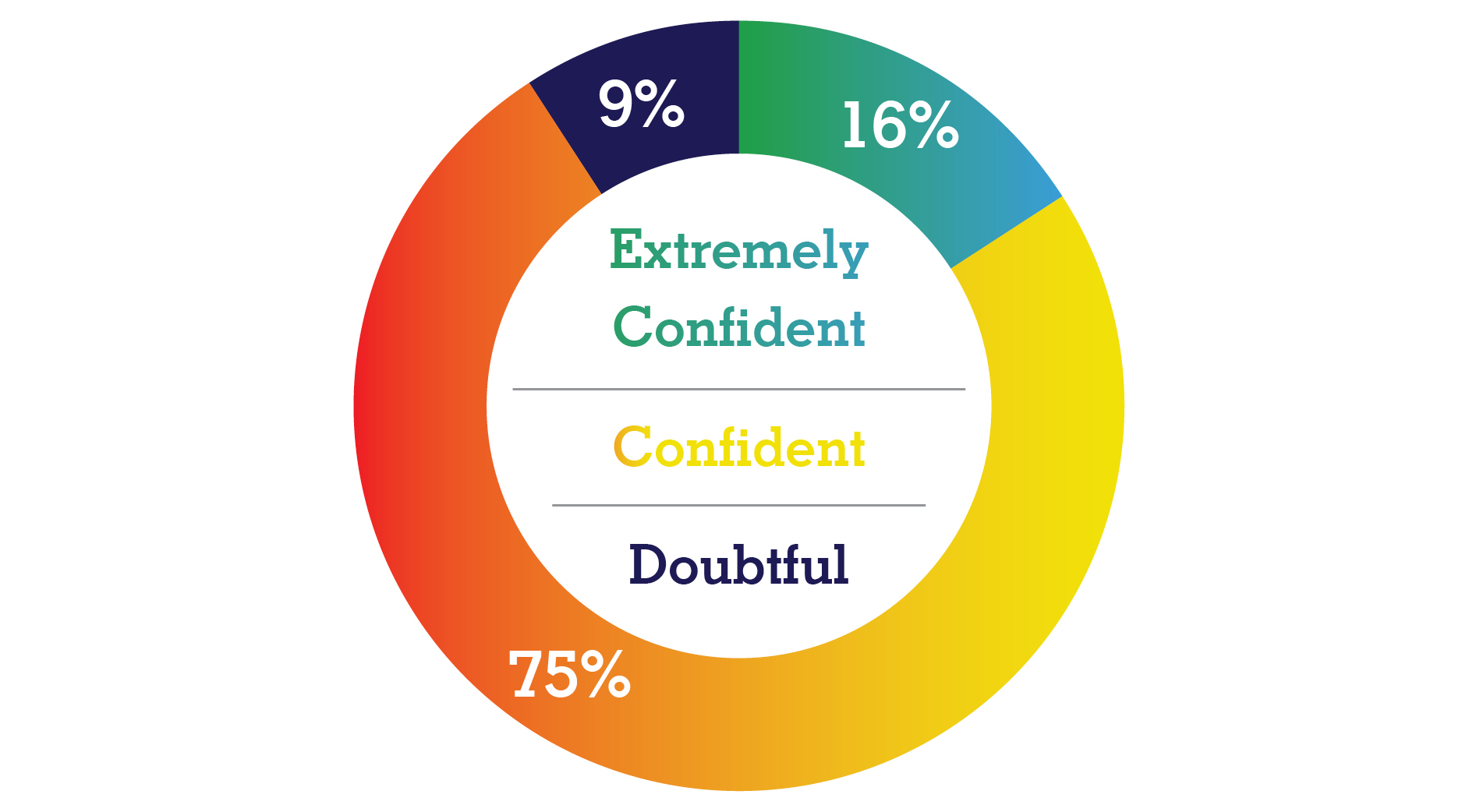

How confident are you that your trade show program will achieve better results in 2023 than in 2022?

Do you have definite or tentative plans to purchase a new exhibit in 2023?

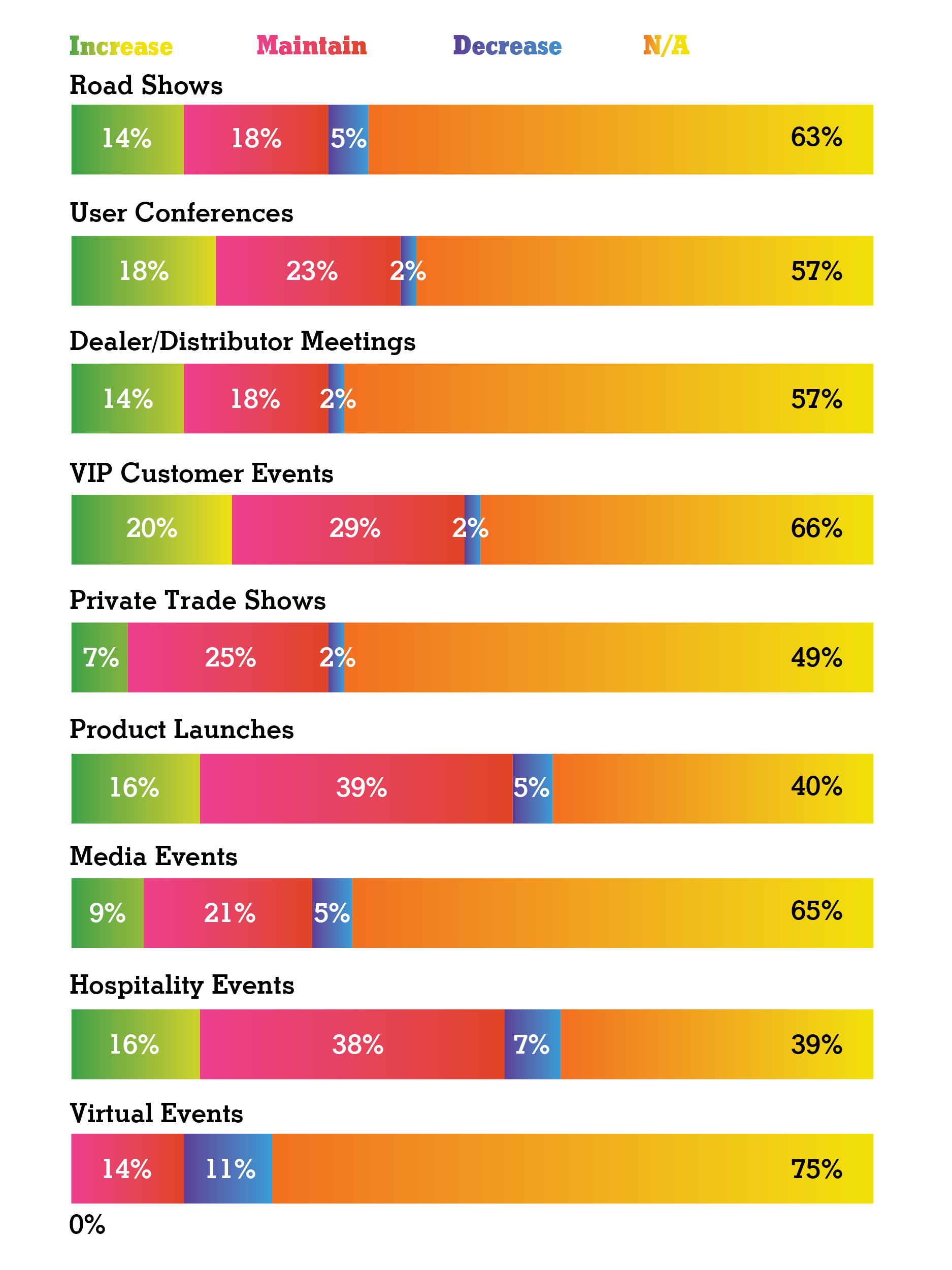

Does your organization plan to increase, maintain, or decrease spending on the following types of corporate events in 2023?

What is your total trade show budget for 2023 compared to your budgets for fiscal years 2020 through 2022?

How many in-person trade shows or events do you plan to exhibit at in 2023, and how many did you exhibit at during the four years prior?

|

|

|

||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

TOPICS Measurement & Budgeting Planning & Execution Marketing & Promotion Events & Venues Personal & Career Exhibits & Experiences International Exhibiting Resources for Rookies Research & Resources |

MAGAZINE Subscribe Today! Renew Subscription Update Address Digital Downloads Newsletters Advertise |

FIND IT Exhibit Producers Products & Services All Companies Get Listed |

EXHIBITORLIVE Sessions Exhibit Hall Exhibit at the Show Registration |

ETRAK Sessions Certification F.A.Q. Registration |

EDUCATION WEEK Overview Sessions Hotel Registration |

CERTIFICATION The Program Steps to Certification Faculty and Staff Enroll in CTSM Submit Quiz Answers My CTSM |

AWARDS Exhibit Design Awards Portable/Modular Awards Corporate Event Awards Centers of Excellence |

NEWS Associations/Press Awards Company News International New Products People Shows & Events Venues & Destinations EXHIBITOR News |

||||||||||||||||||||

|

||||||||||||||||||||||||||||