|

REGISTRATION REQUIRED

planning

Show Selection: Five Steps to Informed Decisions

Whether your budget is $10,000 or $10 million, managing an exhibit program is a Herculean undertaking. It requires thousands of decisions about branding and booth staffing, tchotchkes and sponsorships, booths and budgets. But the success or failure of all those things rides on the back of the most fundamental decision of all: which shows are worthy of your exhibit-marketing investment.

Choosing from the mass of prospects can be daunting, tempting exhibit managers to stick to the familiar when spending the company dime. But to do so, says Ian Sequeira, executive vice president of Red Bank, NJ-based Exhibit Surveys Inc., is to risk squandering an exhibiting budget at shows where the return on investment is, at best, inferior, and at worst, nonexistent. Selecting the most appropriate shows requires a measured approach of five steps, and there are no shortcuts. It demands introspection, scrutiny, and research, and above all else, time. But so tried and true is the process that Sequeira teaches it as part of the core curriculum of the Certified Trade Show Marketer (CTSM) certification program. Here, then, is his five-step method to exploring, evaluating, and ultimately selecting shows most likely to optimize your company's investment.

Sequeira says the first and most often skipped step of the show selection process is to survey internal departments and scour industry info to understand the marketplace, where your company fits into it, and where the C-suite wants to be in the future. This step is especially important for those new to a company, but Sequeira believes it is a critical step even for seasoned exhibitors, as without it, they are operating on assumptions that might be outdated. For example, conversations with sales and marketing might reveal frustration over the underperformance of a particular product in the company's portfolio, and there might be shows available that are more specifically suited to the target audience for that item. You might also find out that management wants to better position the company as a thought leader in your industry, requiring consideration of shows with speaking opportunities. On the other hand, if company brass wants to increase visibility, an exhibit manager might consider exhibiting at a large number of shows with small booths, while if the company sentiment is to take on a particular competitor, it might be more appropriate to look for shows where competitors exhibit, and go in big with a large booth space and sizeable sponsorships. Gathering intelligence on your industry sector might also uncover that attendees are increasingly being lured to private events or regional shows rather than large national expos. This could cause an exhibit manager to question the percentage of resources allocated to national or international events. Or it may unearth new regional shows, a dip in market share for a given product, or financial struggles within a particular segment – any of which could influence decisions regarding where and how to allocate your investment. Failing to complete this research makes you ill-equipped to effectively evaluate your options. "This knowledge is critical because if you're off base at this stage, you'll be wrong throughout the rest of it," Sequeira says. "This essentially drives the process of which events to select and what information is critical to helping you evaluate shows."

Whether you use a formal survey conducted by an agency or an informal questionnaire mailed by the marketing department, asking current and prospective clients about their intentions and behavior regarding trade shows can net information that is immeasurably valuable. The challenge is finding the right people – and enough of them – to gather reliable data. In addition to surveying an internal list of clients and prospects, you might be able to find other survey candidates via associations or show organizers in your industry that sell mailing lists of members or registered attendees. Sequeira warns that a suitable sample size is necessary for any data that is collected to be meaningful. In general terms, several hundred replies are needed for a valid email poll, and 25 in-depth interviews are considered the baseline for credible feedback from focus groups. Ask your survey or focus-group participants what shows they plan to attend, the nature of their buying cycles, and their general awareness of your company and its offerings. But the most critical question, according to Sequeira, is what level of interest the respondents have in seeing your company's type of products. "Our research shows that attendees' product interest is the best predictive indicator of a company's potential for success in an event. Far and away, it has the most correlation to at-show success than any other statistic we measure," he says. If a significant percentage of respondents say they plan to attend a particular show, but a low percentage of them are interested in your product category, that needs to factor highly into your decisions on whether or not the show is a viable option. Bottom line, just because your target audience is there doesn't mean your offerings are on their shopping list.

Once feedback has been gathered, assemble a list of potential trade shows, including those the company has previously attended, ones mentioned by current or prospective clients, and any unearthed during your research. This should include shows found on competitors' websites, association websites, and search engines specifically for the exhibition industry including www.mytradefairs.com, www.biztradeshows.com, www.eventseye.com, and www.tsnn.com. Keep in mind, no single directory lists every single show (so plan to use more than one), and the information supplied via these directories is often incorrect (particularly when it comes to attendance figures). The directories are usually not to blame, however, as they must rely on data submitted by show management, and it's not unheard of for organizers to pad their attendance numbers. For this reason, Sequeira cautions against using directories to choose or eliminate shows. Rather, he suggests drawing from several to create your "exhibiting universe" on a spreadsheet without putting too much stock in the detailed information that directories provide. This universe will probably contain far more shows than you'll ever attend, including marginal shows on the fringe of your industry that may or may not be beneficial, but it should present a comprehensive list of the face-to-face opportunities before you. This spreadsheet should include spaces where you can add information collected during your research, such as growth or decline of a given show, whether prospective clients say they plan to attend, and whether or not competitors have historically exhibited there. In step four, you will add data collected from show organizers to the spreadsheet as well, but not all the shows on the page at this point will make it to that stage of scrutiny. If there are shows on your spread-sheet that you know your company absolutely will not attend for whatever reason, they can be culled. This might include events in a geographic area that you do not service, shows that are organized by competitors, etc. But those that remain, including shows you currently attend, should go through the next steps of the process in order to earn space on your calendar.

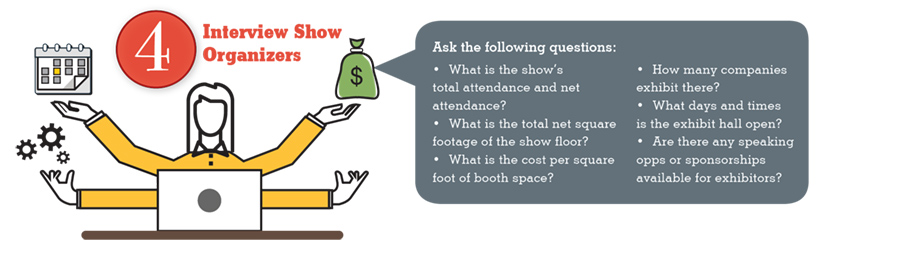

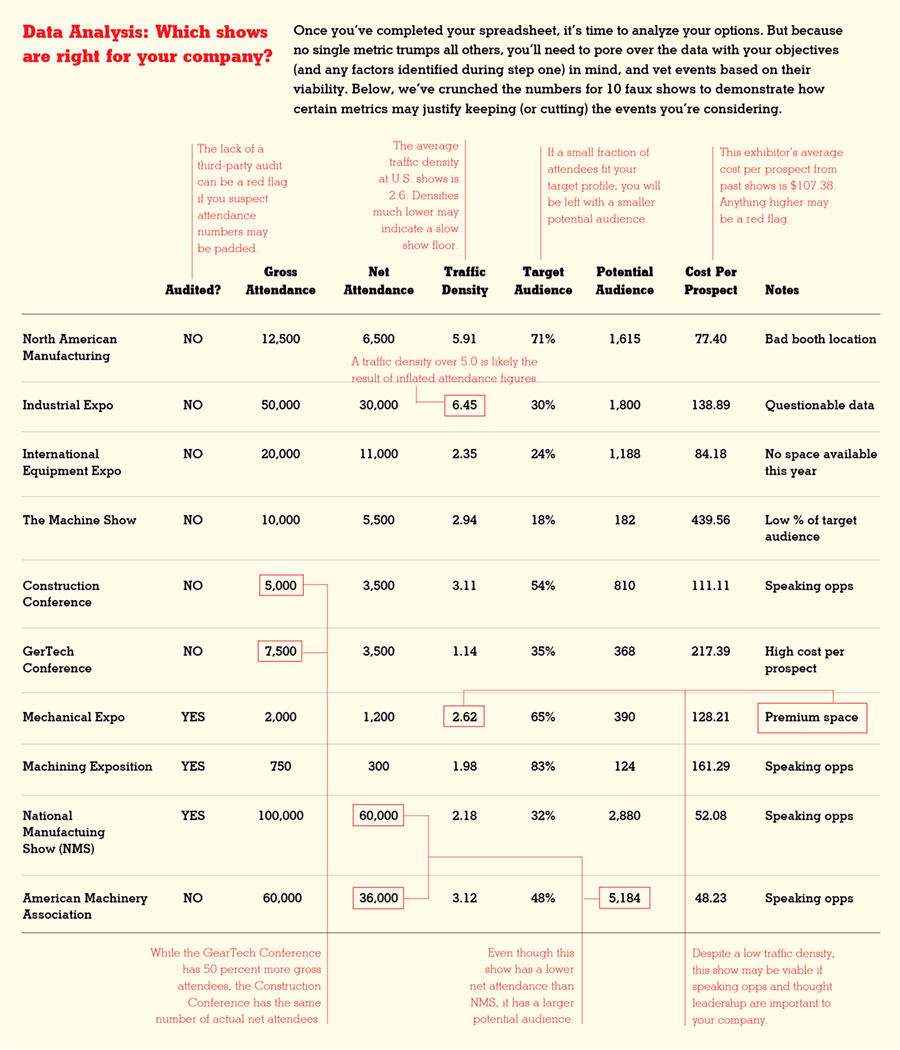

To make an exhibition earn its keep and vet new events, exhibit managers must interview show organizers, and according to Sequeira, the first question should be whether or not the show has been independently audited. Shows that are audited are the most transparent events in the industry because attendance and other figures are verified to be accurate by an independent third party. Trusting numbers provided by shows that are not audited is a risk. Despite its minimal cost, only about 70 of the estimated 10,000 shows in the United States have their numbers audited. Because unaudited figures are questionable, and because attendance alone doesn't make an event better than others, Sequeira advises asking show organizers a series of questions that might help in determining the event's real metrics. If a show seems promising at this stage, there will be other deeper questions, but these lay the groundwork for evaluating an event's viability and suitability for your company: total show attendance, net attendance (i.e., how many bona-fide buyers were physically present, minus exhibitors, staffers, etc.), number of exhibitors, total net square footage of exhibit space (not gross square footage of the show), cost per square foot, and hours, days, and dates for the exhibit hall and educational programs. This is information that every show organizer should be prepared to provide, and Sequeira warns that exhibitors should be wary of any who can't. More and more organizers are also surveying attendees to collect demographics, geographical market information, audience quality (such as buying influence levels and size of budgets), and degree of interest in seeing various types of products or services. Some of the shows on your spreadsheet may go by the wayside at this point if the answers to these questions indicate they are an obvious miss for your company's target market. For the rest, more questions are in order. Ask organizers for a copy of the last show program and exhibit directory. Inside will be a wealth of info about who the 10 largest exhibitors are and what products they sell, whether your competitors are exhibiting and at what level, and what size exhibit would likely be needed to create an impact. Also, reach out to a few past exhibitors and ask for their feedback about the show in terms of audience quality, floor traffic, show management, and so on. None of these pieces of information alone should represent a deal breaker, Sequeira says, but each becomes a piece of information for consideration on the exhibiting-universe spreadsheet. Furthermore, ask questions related to any priorities or objectives you iden-tified during step one. For instance, if opportunities to present sessions or sponsor parts of the show are important to your organization, add related fields to your spreadsheet. Anything that could potentially set an event apart for your company should be noted, along with associated costs. And, last but not least, inquire about the availability of booth space and where it is located in the exhibit hall. If space is not currently available at an event, you may want to table it for consideration the following year. Or if the only spaces available are in bad locations, that may be an important factor to weigh in your analysis.

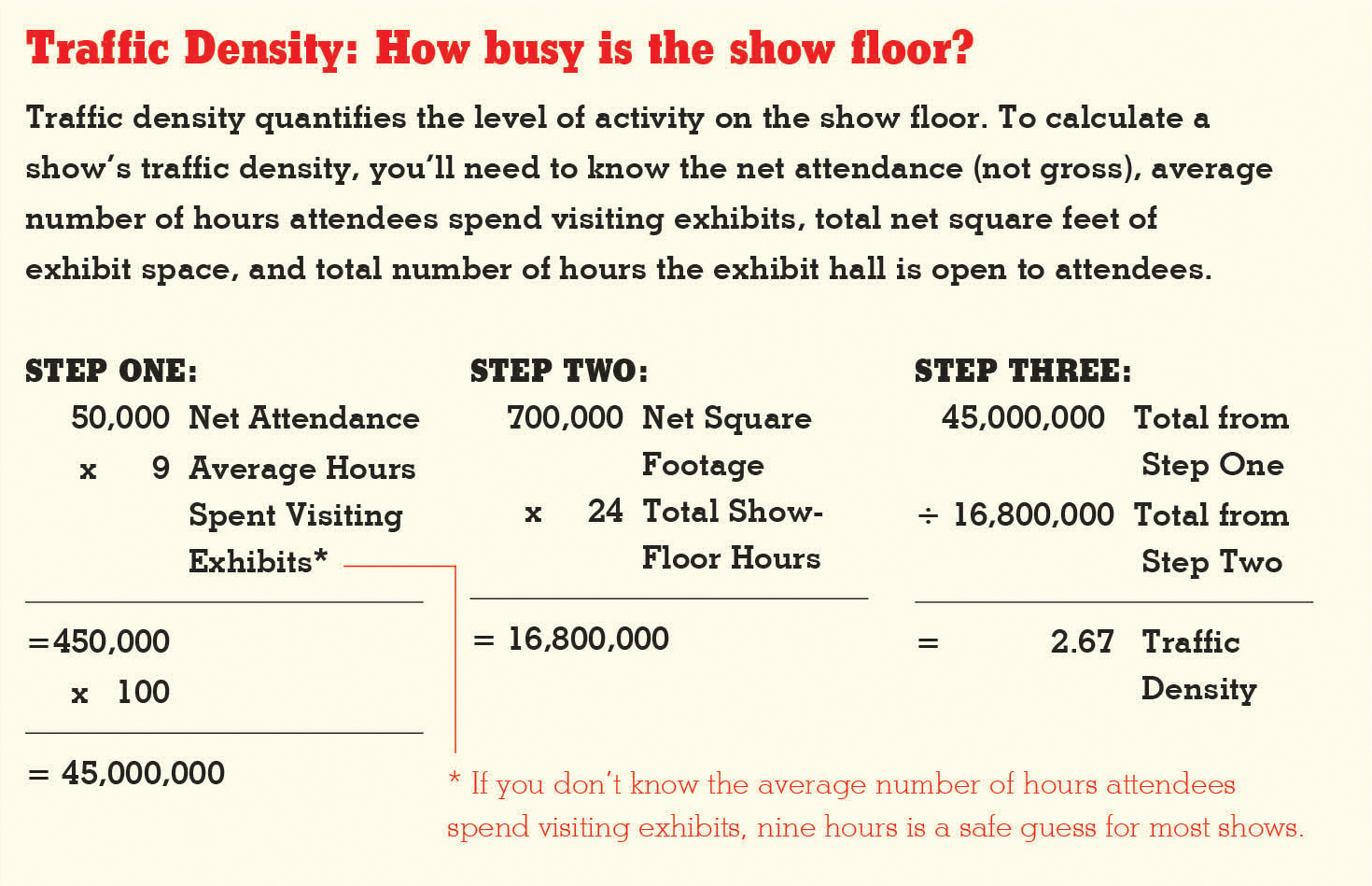

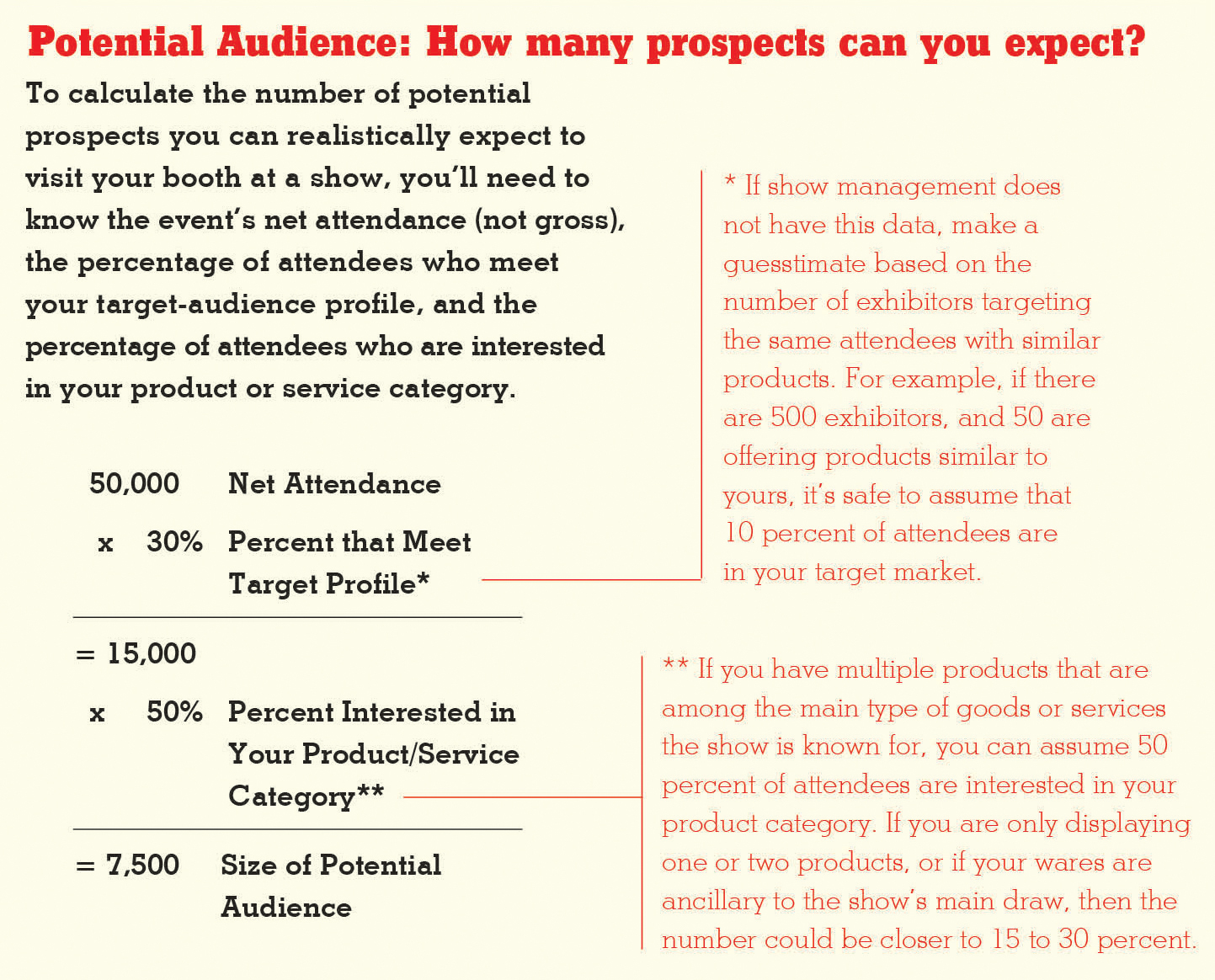

The most critical step of your analysis is determining an accurate attendance figure, as all other calculations rely on it. If a show's organizer has only provided the gross attendance, Sequeira says the rule of thumb is that at least 34 percent of that figure constitutes exhibitors. If organizers provide a figure for net attendance, then exhibitors have already been subtracted. But keep in mind that if a show is not audited, you will need to apply a litmus test to determine the validity of those figures. A second important variable is traffic density, or the number of attendees occupying every 100 square feet of show-floor space throughout the event. Calculating traffic density is a good way to both test the likely accuracy of a show's published attendance numbers and estimate whether an exhibit hall is bustling or boring. To find this figure, multiply the net attendance by the average number of hours attendees spent in the exhibit hall. Then multiply that by 100. If you don't know how much time attendees spent on the show floor, Sequeira says, nine hours is a safe guess, though it may be as few as six hours for shows with less than 100,000 square feet or as high as 12 to 15 hours for shows with more than 500,000 square feet. Next, multiply the total net square feet of the show floor by the number of hours that the show floor is open. Then divide the total from the first calculation by the total from this second calculation, and you have arrived at the average show floor density. According to research by Exhibit Surveys, the average traffic density at U.S. shows is 2.6, and densities much lower than that might indicate a show floor with less traffic than exhibitors would consider acceptable. On the other hand, Sequeira warns that densities higher than 5 or 6 are generally a sign of number padding. To wit, even the International Consumer Electronics Show (CES), which is the king of U.S. trade shows (and is audited) only has a traffic density of 3.5. If a calculation for a show results in a density much higher than the U.S. average, Sequeira says, the attendance numbers provided are likely inflated, and you should weigh any additional calculations using that attendance figure skeptically. Using the most realistic attendance numbers possible, determine how many of those attendees represent prospects who are interested in your offerings and likely to visit your booth. This is known as your potential audience. If you or the organizer has already surveyed attendees to determine demographics, buying plans, and/or interest in your category of products or services, you're a step ahead of the game. If show management does not have such information available, make a guesstimate based on what percent of the exhibiting companies are there targeting the same individuals with similar products, and figure your audience is about that same portion of overall attendance. For example, if there are 500 exhibitors at the show, and 50 of them are selling products similar to yours, it's a relatively safe bet to assume that roughly 10 percent of attendees are interested in your offerings and likely to represent your target market. Then, multiply the show's total attendance by the percent that comprise your target. For example, if 30 percent of attendees represent your target market, and the show has 10,000 net attendees, your theoretical audience would be 3,000 people.

Now, using the square-foot costs provided by organizers, estimate what you would likely pay for a spot in the show, and, if possible, add to that any shipping, labor, travel, or other show costs you can ballpark for an event in that location. Divide that figure by the number of people in your potential audience. For instance, if you anticipate spending $327,000 at an event with a potential audience of 1,500 attendees, the estimated cost of reaching a prospective client there would be $218. With all of this information plugged into your exhibiting universe spreadsheet, you now have the tools to make informed decisions about how to spend your budget. Notes gathered during step one that express the company's goals should be nearby, providing a compass when surveying the field of potential shows before you. Once put through the analytical process, shows might rise to the top that an exhibitor otherwise wouldn't have explored, and that's why even seemingly unlikely events should be vetted before being dismissed. "You may still go to a show that is very, very small but has a high concentration of your target audience," Sequeira says. "For example, it might only have 200 attendees, but if all of them are potential buyers of your product or service, then that show is most likely worth your investment." Likewise, shows considered a staple in your exhibiting program may fall off the list if competing events offer better marketing opportunities or a larger pool of attendees who meet your target-audience profile. While there is no shortcut for collecting the aforementioned data, the information is available, Sequeira says. But the onus is on the exhibit manager to use it to make good decisions. Like most investments, there's still a degree of risk involved in exhibiting at any given show, even if all the numbers bear out. But that risk is significantly diminished by implementing this approach, which turns simple guesswork into thoughtful analysis, allowing you to make fully informed decisions. E

|

|

|

||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

TOPICS Measurement & Budgeting Planning & Execution Marketing & Promotion Events & Venues Personal & Career Exhibits & Experiences International Exhibiting Resources for Rookies Research & Resources |

MAGAZINE Subscribe Today! Renew Subscription Update Address Digital Downloads Newsletters Advertise |

FIND IT Exhibit Producers Products & Services All Companies Get Listed |

EXHIBITORLIVE Sessions Exhibit Hall Exhibit at the Show Registration |

ETRAK Sessions Certification F.A.Q. Registration |

EDUCATION WEEK Overview Sessions Hotel Registration |

CERTIFICATION The Program Steps to Certification Faculty and Staff Enroll in CTSM Submit Quiz Answers My CTSM |

AWARDS Exhibit Design Awards Portable/Modular Awards Corporate Event Awards Centers of Excellence |

NEWS Associations/Press Awards Company News International New Products People Shows & Events Venues & Destinations EXHIBITOR News |

||||||||||||||||||||

|

||||||||||||||||||||||||||||