consolidation |

|

|

ALL STAR |

Sue Huff, the director of global conventions for medical-device maker Medtronic Inc., worked in public relations for a show organizer for several years before joining Medtronic. A 25-year veteran of the company, she leads the global exhibit-design program for all its businesses. Huff also currently serves as the president-elect of the Healthcare Convention and Exhibitors Association (HCEA) Board of Directors. Sue Huff, the director of global conventions for medical-device maker Medtronic Inc., worked in public relations for a show organizer for several years before joining Medtronic. A 25-year veteran of the company, she leads the global exhibit-design program for all its businesses. Huff also currently serves as the president-elect of the Healthcare Convention and Exhibitors Association (HCEA) Board of Directors.

|

|

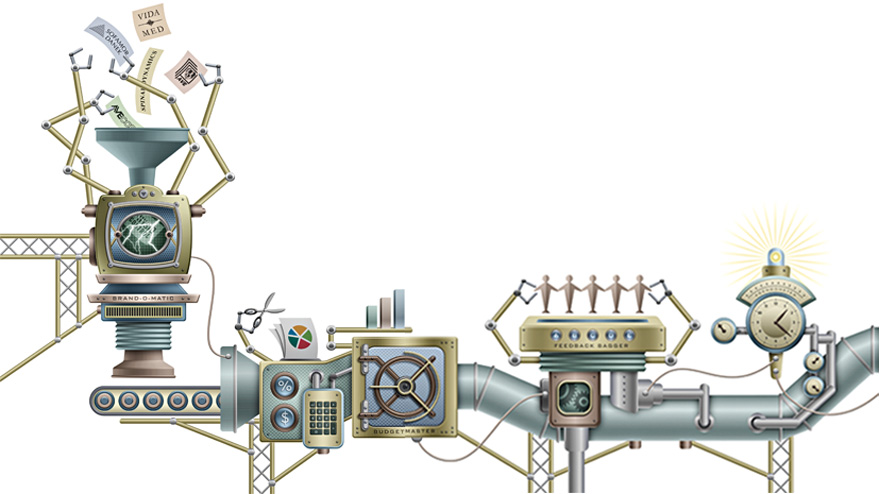

ue Huff doesn't look a thing like Henry Kissinger, or sound much like the gravel-voiced former secretary of state either. But the director of global conventions for medical-device maker Medtronic Inc. proved her diplomatic mojo was every bit the equal of the Nobel Prize-winning politician. Charged by management with overhauling Medtronic's exhibiting program, Huff took a company whose brands were as fragmented as the post-Cold War Soviet Union and unified them under one corporate flag through her diplomatic deftness and organizational smarts. It's little wonder, then, that one of our All-Star Awards judges called Huff's entry, "An amazing story about an amazing manager." ue Huff doesn't look a thing like Henry Kissinger, or sound much like the gravel-voiced former secretary of state either. But the director of global conventions for medical-device maker Medtronic Inc. proved her diplomatic mojo was every bit the equal of the Nobel Prize-winning politician. Charged by management with overhauling Medtronic's exhibiting program, Huff took a company whose brands were as fragmented as the post-Cold War Soviet Union and unified them under one corporate flag through her diplomatic deftness and organizational smarts. It's little wonder, then, that one of our All-Star Awards judges called Huff's entry, "An amazing story about an amazing manager."

By 2002, when Huff was promoted from senior convention manager to the directorate position after

15 years at the company, Medtronic was quickly expanding. From its 1949 origins in a ramshackle garage, the Fridley, MN-based company had grown into a medical dynamo with almost $6 billion in net sales in 2002, thanks to life-saving inventions such as the first wearable, external, battery-operated pacemaker and the first implantable drug pump to treat cancer pain. In order to keep growing and stay competitive with heavyweight rivals like Boston Scientific Corp., Medtronic had acquired 10 major medical-technology companies from 1990 to 2002 alone.

That flurry of acquisitions split the company into fiefdoms of nearly a dozen different brands. "We had as many as four different brands exhibiting at a single show, each with a different booth, signage, and branding," Huff says. "That made it confusing for the customer."

Recognizing that the Sybil-like set of subsidiary brands could weaken the company, management embarked on a master-brand strategy. Instead of initiating that effort with mainstream advertising as some companies might have, however, management had decided that there was no better place to start unifying the brands than the annual mix of 200 conventions Medtronic attends in the United States.

Trade Show Triage

Into this fragmented picture, Huff entered as Medtronic's new director of global conventions. She immediately encountered a company whose five divisions (such as spinal, vascular, and cardiac rhythm management) encompassed 12 separate brands. Each of the dozen brands in turn had its own exhibiting program, with properties running from tiny tabletops to a colossal 6,600-square-foot booth. The situation wasn't exactly inoperable, but the divisions' hands-off-our-brand attitude was potentially malignant.

To transform that bedlam of booths into a cohesive program would require jettisoning the individual exhibiting systems and replacing them with a newly built, centrally controlled exhibit that all would share. Huff also wanted to replace most division-specific signage with graphics expressing only the overarching Medtronic brand.

Cost Consultation

Hippocrates' priorities for medical professionals may have started with "First, do no harm," but Huff's priority for Medtronic was the more practical, "First, get the money." With the help of Medtronic's finance department, the various business units' marketing departments, and the units' convention planners, Huff estimated the cost of such a transformative exhibiting program and then approached management with a request for funds that reached into six figures. Even though management wanted the program to execute its master-brand approach, that didn't mean they would automatically offer Huff carte blanche to do it. Realizing that pitching management on the merits of a centralized program's strategic potency would not be enough, Huff crafted a financial argument to support the marketing one.

By reducing the number of exhibits from 12 down to one, she suggested, the company could save considerable money in its capital exhibit investment, operational expenses, and storage. Moreover, there would be greater purchasing power with one exhibiting department bulk buying for 12 subsidiary exhibitors, instead of each negotiating separately. With a prognosis like that, management gladly gave her the green light.

|

|

Even with management's

imprimatur, Huff was careful not to overplay her hand. Knowing how important getting buy-in from the various divisions would be to her chances of success, she approached the heads of the five divisions' marketing departments, requesting that they enlist members for the "vendor-selection team." It was vital they be empowered to make decisions for their departments. With the clock ticking - it was May 2002, and the new exhibit would be launched in January 2003 - Huff couldn't waste precious minutes with committee members shuttling back and forth to their respective divisions for input and authority. Eventually, she recruited six members.

Prebuild Preparations

Like a surgeon prepping before an operation, Huff had researched 250 exhibit houses while she was recruiting the team. Once she whittled down the 250 to 26 (she simply used her prior knowledge of some firms and whatever she could glean from the companies' websites to get a sense of their suitability), she brought in a market researcher who had previous experience with Medtronic to cull the remaining contenders.

Using a questionnaire Huff developed that vetted the remaining 26 for a variety of factors, such as the size of their facilities, their number of staff, and what percentage of their work was pop-ups, rentals, and custom builds, the researcher pared the list

to 10. Next, the analyst interviewed the remaining hopefuls over the phone, digging deeper into the kinds of clients with which they had previously worked, their international experience, how they kept abreast of design trends,

and even their company history and corporate philosophy. Once Huff, the researcher, and the vendor-selection team had dissected each applicant, they narrowed the 10 down to a final four.

Huff and the team then traveled to each competing vendor's facilities, where each prospect offered a tour of its physical plant and made what was essentially an audition before the Medtronic contingent. All of the competing vendors were capable of managing the account, Huff felt. But during the presentations, the Medtronic team came to a collective conclusion: They wanted a partner who would help them achieve their business objectives, not just a talented designer who would give them a shiny new booth.

Ultimately, Huff and her team found their partner/maverick in Group Delphi, an Alameda, CA-based exhibit house that focused its pitch on how Medtronic's booth could be made more effective and memorable by using innovative technologies to address attendees' different learning styles. This was an aspect the various Medtronic booths, choked with each brand's signage and bloated with products like a garage sale, had never embodied.

Exhibiting Observations

Once the team had made the final decision, Huff called the winner, congratulated the company warmly, and then sent Group Delphi reps packing - to five different medical conventions the following week. Coincidentally, it was the busiest exhibiting period of the year for Medtronic.By sending Group Delphi to expos as varied as the Mechanism of Perfusion and the North American Society of Pacing and Electrophysiology conventions, Huff hoped the designers would learn firsthand about the company's exhibiting challenges and competitors.

With the exhibit house in tow, Huff and the team now moved to the actual design phase of the new booth. Huff reached out to each division with what she now calls "The Listening Tour." Over the next 90 days, from May to September, she and her team met more than 35 times with the various marketing groups within each division around the country. There, in hours-long sessions, Huff absorbed the concerns of the marketing departments, as well as the convention and trade show staff. Many advocated for better demo areas, clearer navigation, and fewer displays of products, changes Huff herself wanted to make but preferred others to suggest.

|

|

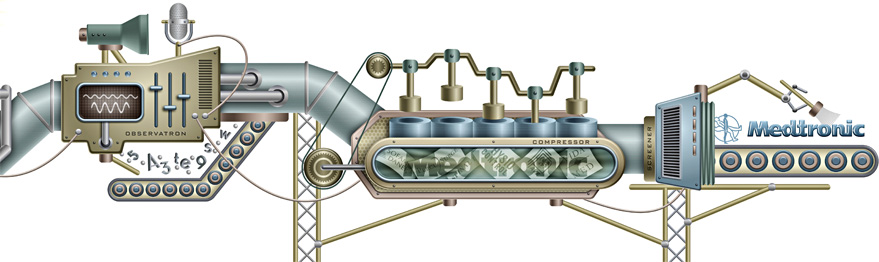

Once The Listening Tour concluded, Huff and Group Delphi took the findings to the exhibit-design team, which shaped the new booth accordingly. To create an exhibit that all Medtronic's divisions could use, the company designed a modular booth that could be scaled up or down to

fit any division's need at any particular show. From its maximum configuration of 6,600 square feet, the new booth could be disassembled into several smaller, discrete units, allowing it to handle a range of products.

When Medtronic debuted the exhibit at the Society of Thoracic Surgeons meeting in January of 2003, the new booth was as different from the old one as a clamp is from a CAT scan. Gone were the umpteen brand logos. In their place was a prominent use of the Medtronic logo. Instead of labeling various sections with the names of specific divisions or products as it used to, Medtronic took its cue from retail stores and marked the booth's sections with generic descriptors of products and therapies, such as pacemakers, heart valves, and pain management.

Gone too was the kitchen-sink approach, where every product, new and old alike, was stuffed into the booth. Instead, Medtronic brought only its newest products, something that surveys and research the company conducted at five 2001 shows suggested attendees strongly preferred. Plus, Huff estimates that the modular exhibit's easy setup reduced

the hours needed for

installation and dismantle by 12 percent, compared to its predecessors.

Surgical Success

By consolidating and streamlining Medtronic's exhibit program, Huff cut capital expenditures, with savings well into the seven-figure range. But the program continued to pay substantial dividends for years after: While Medtronic keeps precise figures as hush-hush as doctor-patient privilege, the savings realized by sharing the same booth across multiple business units, reducing the amount of required exhibit storage space, and negotiating for several brands en masse are still adding up.

Perhaps the greatest testament to any formula is how well it can be reused. In 2007, Huff exercised the same diplomatic approach when the company decided to nearly double the booth to 13,000 square feet to accommodate new brands acquired since the first overhaul and the subsequent stream of new products. Joined by a team recruited from the various divisions, she embarked on an international Listening Tour, this time ranging from South Korea to Switzerland.

In 69 meetings over three months, she compiled all the logistical and design needs the international offices had for the exhibit. More than just a sponge bath of perfunctory politeness, Huff's tour soothed their concerns and paved the way for an improved booth. To better catch the eye of attendees passing by, for example, Medtronic built a "connection space" in middle of the booth to draw visitors in. While the old exhibits placed demo counters around the booth's perimeter - in effect becoming barriers that discouraged guests from exploring deeper into the exhibit - the connection space beckoned with in-booth presentations, reception areas, and even casual seating. With the cost savings of her smooth-running program still accruing for Medtronic after nearly a decade, Sue Huff is clearly just what the doctor ordered. E

|

|

|

Sue Huff

Sue Huff ue Huff doesn't look a thing like Henry Kissinger, or sound much like the gravel-voiced former secretary of state either. But the director of global conventions for medical-device maker Medtronic Inc. proved her diplomatic mojo was every bit the equal of the Nobel Prize-winning politician. Charged by management with overhauling Medtronic's exhibiting program, Huff took a company whose brands were as fragmented as the post-Cold War Soviet Union and unified them under one corporate flag through her diplomatic deftness and organizational smarts. It's little wonder, then, that one of our All-Star Awards judges called Huff's entry, "An amazing story about an amazing manager."

ue Huff doesn't look a thing like Henry Kissinger, or sound much like the gravel-voiced former secretary of state either. But the director of global conventions for medical-device maker Medtronic Inc. proved her diplomatic mojo was every bit the equal of the Nobel Prize-winning politician. Charged by management with overhauling Medtronic's exhibiting program, Huff took a company whose brands were as fragmented as the post-Cold War Soviet Union and unified them under one corporate flag through her diplomatic deftness and organizational smarts. It's little wonder, then, that one of our All-Star Awards judges called Huff's entry, "An amazing story about an amazing manager."