hen was the last time you ordered new checks? If you’re like many Americans, chances are you’ll have a tough time remembering. What with so many payment alternatives — debit cards, credit cards, electronic fund transfer, direct debit, automatic bill pay — we’re writing fewer and fewer checks each year. And that’s been a huge problem for Shoreview, MN,-based Deluxe Corp., the world’s most notable check printer. hen was the last time you ordered new checks? If you’re like many Americans, chances are you’ll have a tough time remembering. What with so many payment alternatives — debit cards, credit cards, electronic fund transfer, direct debit, automatic bill pay — we’re writing fewer and fewer checks each year. And that’s been a huge problem for Shoreview, MN,-based Deluxe Corp., the world’s most notable check printer.

Since 2002, the Deluxe annual report has noted the decline of what has traditionally been its core business. Check-writing peaked in the mid-1990s, and from 2001 to 2004 it decreased by 4.3 percent each year, according to the Federal Reserve. Deluxe estimates that the number of personal checks written continues to fall at that rate, or faster.

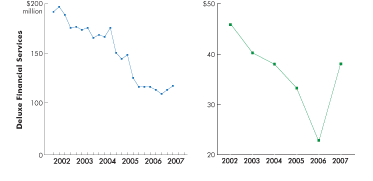

Deluxe’s three divisions — Small Business Services, Financial Services, and Direct Checks — have seen revenue decline during the past several years, and the company felt the sting of an unprecedented quarterly loss in 2006. According to a recent Twin Cities Business article, Deluxe is working hard to slow the slide in revenue in its Financial Services (which includes its heritage business, printing checks for banks) and Direct Checks segments (which sells checks directly to consumers) “by taking them from the 14 to 15 percent year-over-year declines they suffered in 2006 to showing single-digit declines.” That, according to the article, would position Deluxe to hold revenues steady in 2007 — a noteworthy accomplishment in the midst of inevitable continued growth among electronic payment methods.

To answer the rise of the debit card and the fall of the checkbook, Deluxe has taken bold steps: consolidating production facilities as check demand declines, and purchasing complementary businesses that have the potential to boost demand for paper forms and checks. Most important, it is constantly in search of promising new product and service opportunities that give it much more to sell than ink on paper.

All of this amounts to a Deluxe transformation. In a major rebranding effort more than five years in the making, Deluxe is stepping away from its starring role as the industry’s check printer, and stepping into the more prestigious — and perhaps one day more profitable — role of a savvy and diverse industry-leading business partner to banks, credit unions, and small businesses.

Humble Beginnings

Leading the transformation is the Deluxe Knowledge Exchange Series (KES), a branded suite of informational and training events and content developed specifically for the company’s financial institution clients.

The KES got its start when Deluxe approached Minneapolis-based Martin Bastian Productions in 2001 for help with a new product launch. “Deluxe came to us and said, ‘We think it should be a small road show, maybe five cities, basic staging. We just need some numbers,’” recalls Amy Oriani, vice president of production and creative services at Martin Bastian.

Slowing the Slide

Judging by its annual reports, Deluxe Corp. is relying heavily on the Knowledge Exchange Series (KES), launched in October 2003, to help it stem the sales slowdown in its check products and services group (Deluxe Financial Services). From 2002 to 2006, that slowdown was considerable as electronic payment options exploded on the market. With KES, the company is putting a spotlight on partnership, services, and non-check products — while using KES customer insights to fill its own product-development pipeline.

|

|

Quarterly Revenue |

Stock Price |

|

|

|

But as the conversation unfolded, it became evident that Deluxe was on a bigger mission. It was out to rebrand itself, and in doing so, to have a chance to offset the financial losses that came with the slide in its core business. Deluxe needed to shake off the just-a-check-printer image and step confidently into the role of knowledge leader and more-diverse solutions provider if it hoped to be as prosperous in the future as it had been during much of its 92-year history.

Thoughts of a product-launch road show soon evaporated, and the beginnings of the KES emerged. The first event in 2003 — the Knowledge Exchange Expo — kicked off the rebranding of Deluxe. “We moved from road show to life-changing series,” Oriani says of the event.

Today, the Knowledge Exchange Expo is a business-planning and personal-growth workshop for executives in banking and financial services. And while the expo is the heart of the series, Deluxe keeps the experience (and its rebranding efforts) going all year long with a variety of regional workshops, Web seminars, newsletters, and the Deluxe Knowledge Quarterly magazine, all branded under the Deluxe KES umbrella of products.

The number of Deluxe clients that want to join their peers under the KES umbrella continues to grow. The company quantifies the interest in the KES suite through a free KES membership program for its clients. By 2006, 4,300 Deluxe clients had signed on for the membership, which grew to more than 5,000 in 2007 — a 16-percent increase in just one year.

A New Way to Connect

The first Knowledge Exchange Expo, held in 2003, launched the KES as an exclusive program providing leading-edge information bankers could use to improve their businesses and the blend of personal and professional experience that helps them manage those businesses. “The whole idea was that we could bring industry executives together to change their world, and to address the issues they were experiencing daily in their business,” says Debra Szumylo, event manager for Deluxe Financial Services. More than four years since its inception, the annual expo now attracts upwards of 700 financial-services executives to hear Deluxe’s messages of business and personal growth.

Historically held on the East Coast, but moving to the West Coast in 2008, the free, two-day expo comprises an off-site welcome reception; a half-day general session featuring inspirational messages from business innovators and informational messages from Deluxe executives; a two-hour session that presents the work of the Deluxe Knowledge Exchange Collaborative, a Deluxe-sponsored industry think tank; and soft-sell afternoon breakout sessions that focus on a variety of Deluxe product offerings.

It’s the sizzle, surprise, and inspiration of the expo’s general session that opens people’s minds to the new Deluxe, as the company uses its keynote to inspire attendees’ creativity about marketing and growth in the traditionally conservative banking and financial-services sector. “At every event, we’ve had one of those goose bump moments,” Szumylo says. “We’re creating an experience for the people who attend. We’re asking them to step out of their usual culture and inspiring them to create an experience for their customers, to create loyalty, to keep them coming back.”

The mind-expanding inspirational messages have come from folks like National Geographic photojournalist Dewitt Jones, Boston Philharmonic Orchestra conductor Benjamin Zander, and brand consultant and business author Joe Calloway, who reframes the more poetic messages back into the realm of the finance industry. It is this intense focus on inspiration and creativity that sets the tone for the entire KES. “We went into this saying the expo was not a sales event,” Szumylo says. “The intent was to educate, network, and show the industry that Deluxe had more to offer than checks.” Deluxe took its “inspiration first” objective so seriously that the first three expo events had no sales component at all. When content about existing Deluxe products was added in 2006, it was done at the attendees’ request, Szumylo says. But the sell is still soft: The product-related sessions at the expo are presented from the client perspective — addressing their problems and needs — rather than touting the Deluxe message and product features.

That’s not to say that product innovation isn’t essential to Deluxe’s KES business objectives. Rather, product innovation initiatives are the capstone of the entire KES suite.

The crown jewel of KES is the Deluxe Knowledge Exchange Collaborative, a think-tank-like consortium of a dozen top financial industry executives who volunteer five weeks a year to chew on a single issue of utmost importance to the financial services industry — the fruits of which Deluxe then shares with the industry during an in-depth, two-hour presentation at the expo.

Deluxe chooses a very broad topic, such as “small-business market,” and collaborative members choose a narrower focus within that, such as “needs assessment.” They brainstorm and research the issues and market needs around that particular topic, and within a few months’ time, they develop and test specific solutions for the good of the financial-services industry.

The financial-services industry executives — all volunteers — dedicate five weeks over the course of the year to the KES process. “Each of the five weeks is in a different locale,” Szumylo says. “These are like retreats; this year we called them ‘quests.’ The executives put the topic into practice, they do interviews, they conduct research.”

This think-tank approach has been used in other industries, such as health care, but it hadn’t been introduced in the financial-services industry until Deluxe made it part of the KES. And despite the arduous work undertaken by the collaborative, Deluxe has no shortage of volunteers. Even in the inaugural year, before anyone realized how popular, important, and relevant the collaborative would be, 57 candidates applied for 12 available spots. In the final mix, executives represent a range of credit unions and banks, large and small institutions — all competitors, all working together.

“The first collaborative, convened in 2004, focused on new-account retention during the first 90 days,” Szumylo says. “From research with financial service partners and their customers, we found that there was much dissatisfaction among customers because the relationship with the bank didn’t develop quickly enough.” To help banks get better at connecting with customers right away, the collaborative created the concept for the Welcome Home Tool Kit (WHTK), which Deluxe ultimately developed and produced.

SOLUTIONS FOR SALE

The WHTK is the collaborative’s first product-development success story. In 2004, the collaborative team considered the first 90 days of a bank’s relationship with a new customer. They knew many consumers felt entrapped by their chosen financial institution. That is, they needed a place to set up a checking account, stash a little savings, and get a debit card. They also needed someone to anticipate their financial needs and provide answers to questions about services such as home loans and investment accounts. But they weren’t often getting that consultative support from their financial institution, and the lousy retention rates during those first fragile days of a new banking relationship proved it. “People don’t want to just be a part of a direct-mail list, but to get information from their bank that is meaningful and helpful to their life,” Szumylo explains.

To that end, the collaborative defined an opportunity that evolved through Deluxe product development into the WHTK. The kit, which includes a communications guide, training materials, props, measurement tools, and additional supporting information, coaches financial-services industry professionals to improve the first 90 days of the customer experience. The support component includes a reading list for executives who want to learn more about creating a positive experience for consumers, refresher documents for those on the WHTK program who need ideas to re-energize their accounts, and coaching calls at various phases throughout the initial stages of the relationship.

Financial institutions, which typically purchase one kit per branch, can further maximize their benefit by taking advantage of fee-based support from Deluxe. Fee-based support includes a range of workshops and programs such as Deluxe Inspires Executives. “This program rallies the leadership team,” Szumylo says. “It gets them ready to jump into the WHTK implementation with full force. It includes a candid discussion about how customer experience can create customer loyalty, and information about how Deluxe developed the WHTK experience design.”

From 2003 to 2006, Deluxe’s revenues from checks and related services declined more than 25 percent, from 89.3 percent to 63.5 percent. The good news is that revenues from other product lines — such as the collaborative-identified WHTK — increased each year helping to offset part of the difference. According to the company’s 2006 annual report, Deluxe is placing tremendous emphasis on developing additional products that will continue that trend. “Providing products and services that differentiate us from the competition is expected to help offset the decline in check usage and the pricing pressures we are experiencing. As such, we are also focused on accelerating the pace at which we introduce new products and services.” The KES expo and collaborative events are critical feeders of that product-development pipeline.

If all the collaboratives resulted in product ideas as clear-cut as the WHTK, developing new products, manufacturing them, and moving them to market quickly would be a cinch. But the idea-generation process is rarely that straightforward.

“Products tend to be inspired by the collaborative as opposed to being directly what the collaborative piloted,” says Martie Woods, Deluxe’s chief experience officer. “As soon as the collaborative accumulates research, we feed it to our internal research group and to our innovation lab, where we test concepts based on the research.” Which means that internal development is taking place, even as the collaborative pursues its own work over the course of six to nine months.

Pilot tests of these innovations generally last eight to 10 weeks, and the results are previewed in Deluxe Knowledge Quarterly magazine, then presented in the major session at the expo. Several new collaborative-inspired products are expected to hit the market in late 2007.

cashing in on the kes

The collaborative is the driving force behind Deluxe’s mission to rebrand itself as the smartest business partner in the financial-services industry. And it is the incubator for new product ideas that Deluxe hopes will drive positive bottom-line results. In both cases, Deluxe enjoys several payoffs. The company is credited as a leader and innovator in the financial-services industry for facilitating the collaborative events and expo presentations, and also adds to its portfolio of products for its financial institution and small-business customers — key constituents in the battle to overcome the continually declining check-printing business. And Deluxe builds goodwill among industry executives who participate in the collaborative, which has become a bit of a star-maker: Some participants end up on their own small speaking circuits, talking with regional professional groups about what they’ve learned through the collaborative.

In the first years of the KES, Deluxe recorded an amazing 97-percent retention rate among clients who attended the expo, a regional workshop, or a Web seminar. Now heading into its fifth year, Deluxe continues to see retention rates that soar above 90 percent among KES participants.

Those top marks for KES loyalty are impressive and telling. Of course, for Deluxe and its shareholders, it’s the bottom line that matters. “Before this, we were getting our revenue from the check-printing program, and out of this series, we’ve developed some non-check revenue,” Szumylo says. “That’s the wave of the future.”

Although Deluxe doesn’t track sales directly inspired by KES events, Woods says that KES components are useful sales tools for the company’s account reps. For a Web seminar, for instance, a rep might go to a client’s office, and spend the hour with that client’s staff, listening to the seminar and sharing ideas over lunch. Woods says it’s an excellent way for the account reps to interact with their clients and enjoy a shared experience without having to sell them anything. “Relationships that begin on the transactional level,” she says, “tend to stay there.”

An investment in the future

The KES suite led the charge to rebrand Deluxe as a leading-edge company with the right, needs-based solutions for the financial-services industry. The event series has been singled out in the company’s annual report for each of the past several years. The significance of the expo has been affirmed, as well, by the financial-services industry: “When we did the first KES event in 2003,” Szumylo says, “we paid for the hotel rooms and the airfare for all attendees. The next time we did it, we asked them to pay. We hoped that after we brought them in the first time, that they would be compelled to attend in the future.”

The plan worked, and the KES expo has continued to command an audience of up to 700 Deluxe clients. Szumylo is hoping the trend continues as the expo moves from its traditional Orlando location to the JW Marriott resort in Phoenix in May 2008.

Research indicates customers want a financial institution that understands their needs and delivers information and services that are useful and timely. And banks, of course, would prefer to have customers who are happy. Deluxe made its clients and their customers happy with the WHTK — a product of the collaborative, showcased at the expo, complemented by supporting KES events and publications.

This complete, branded event and information suite, led by the expo at its center, is moving Deluxe into resurgent territory. The company is stepping smartly into its role as a savvy partner to financial institutions and small businesses. The expo, collaborative, and events infrastructure of the KES are fully aligned with its charge to develop new products, and fast. That means the company is positioned to make everyone in the financial-services industry a little happier. And the more merry-making Deluxe can do for its clients, the better its bottom line will be.

|